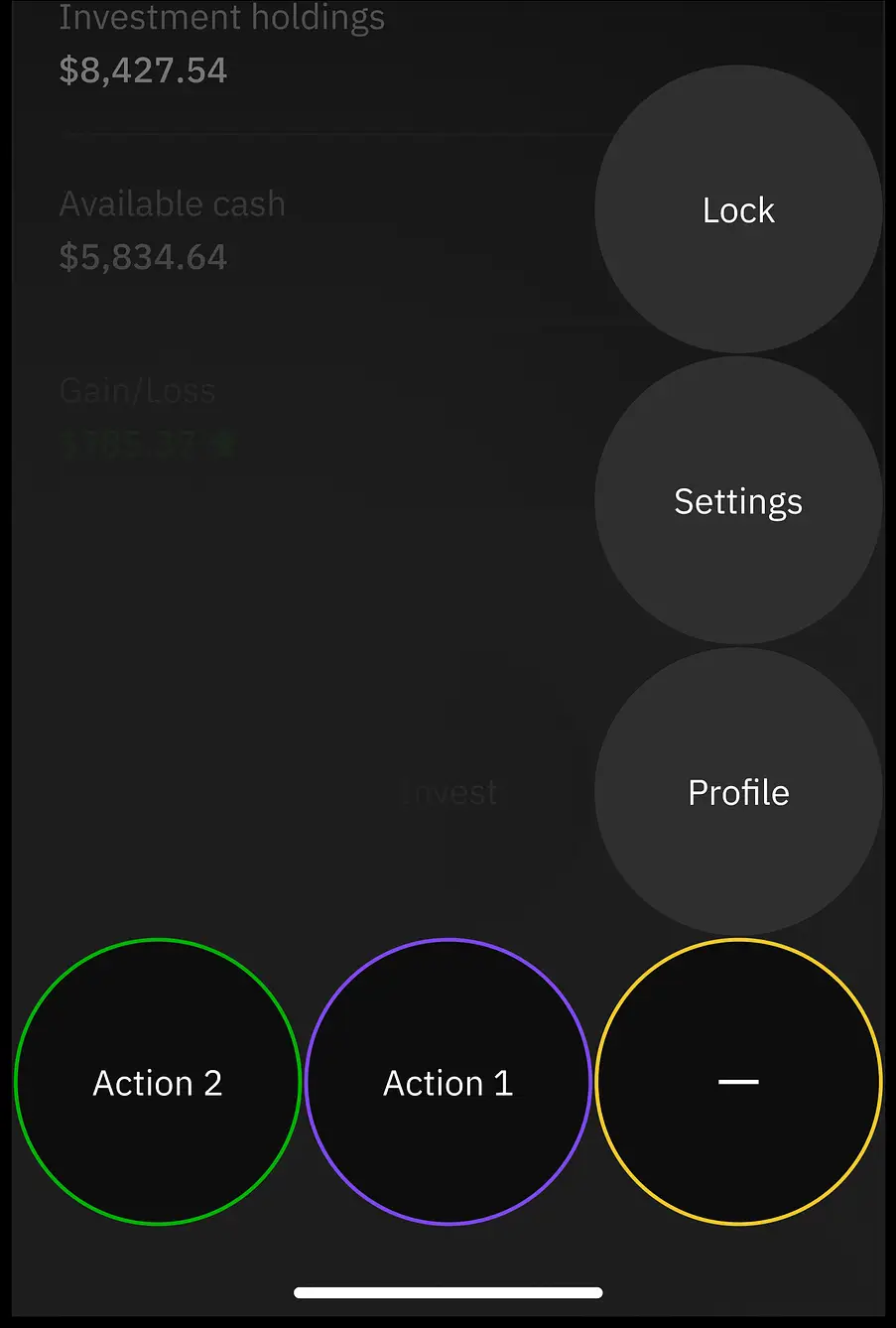

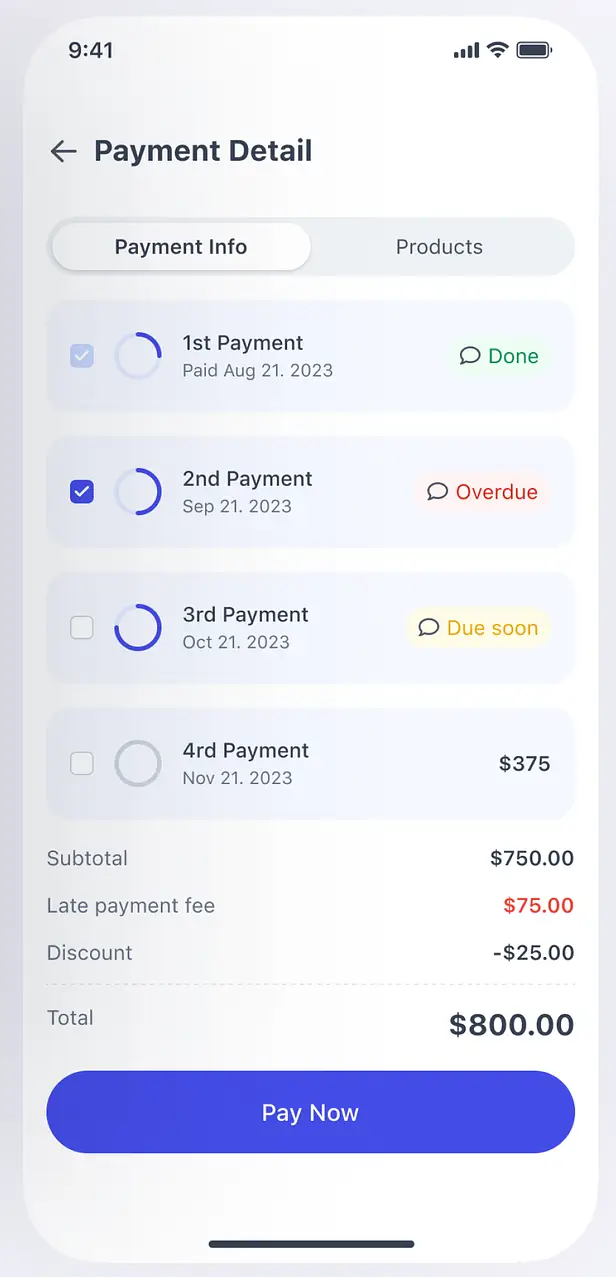

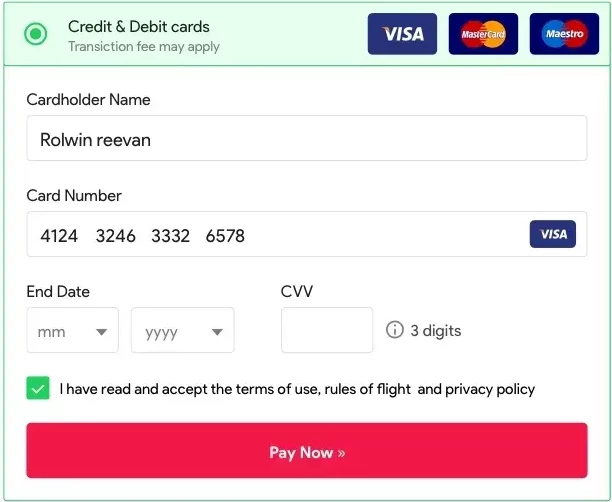

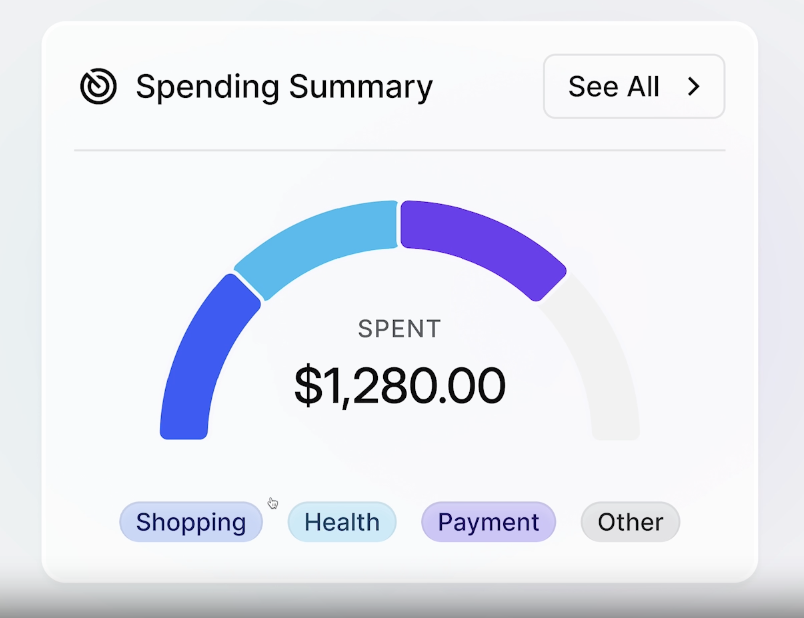

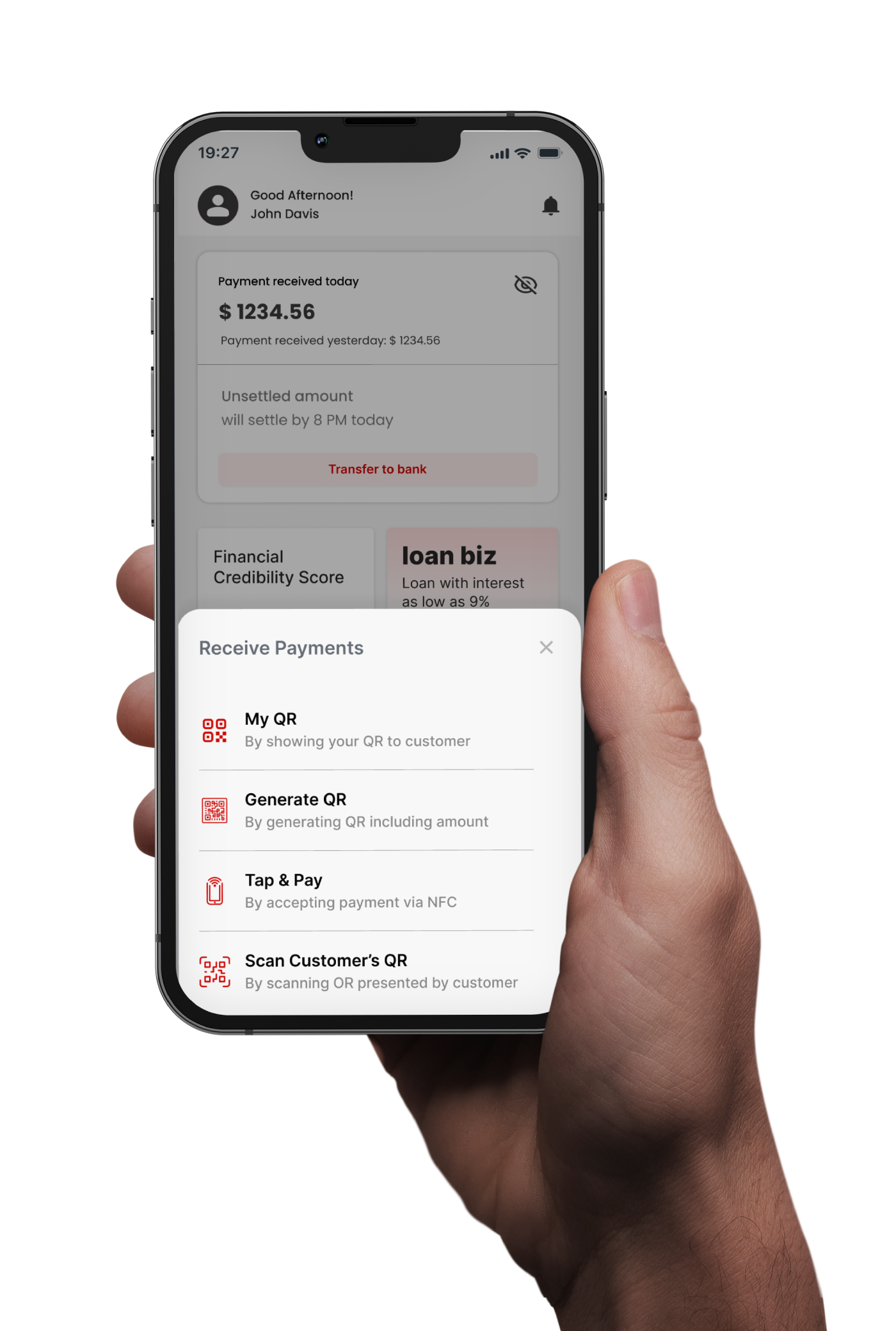

Our Interoperable Payment Network integrates various financial players into a unified system, enabling rapid adoption and seamless transactions by leveraging cutting-edge technologies like real-time payment processing, QR codes, NFC, and digital interfaces.

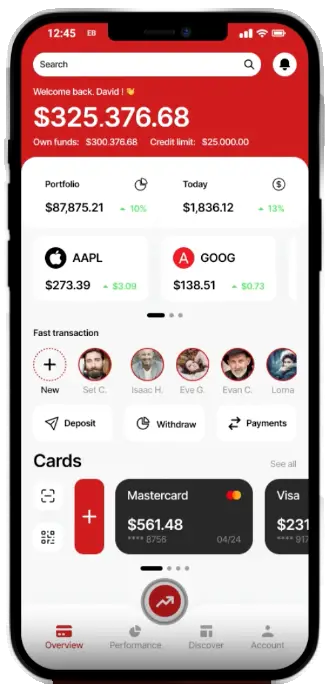

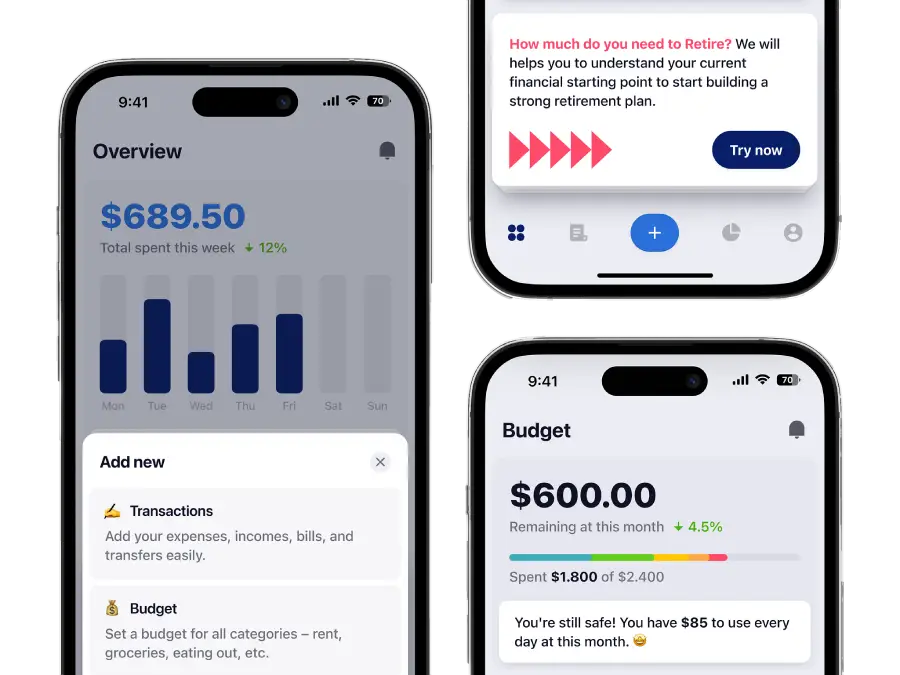

Unified Payment Interface

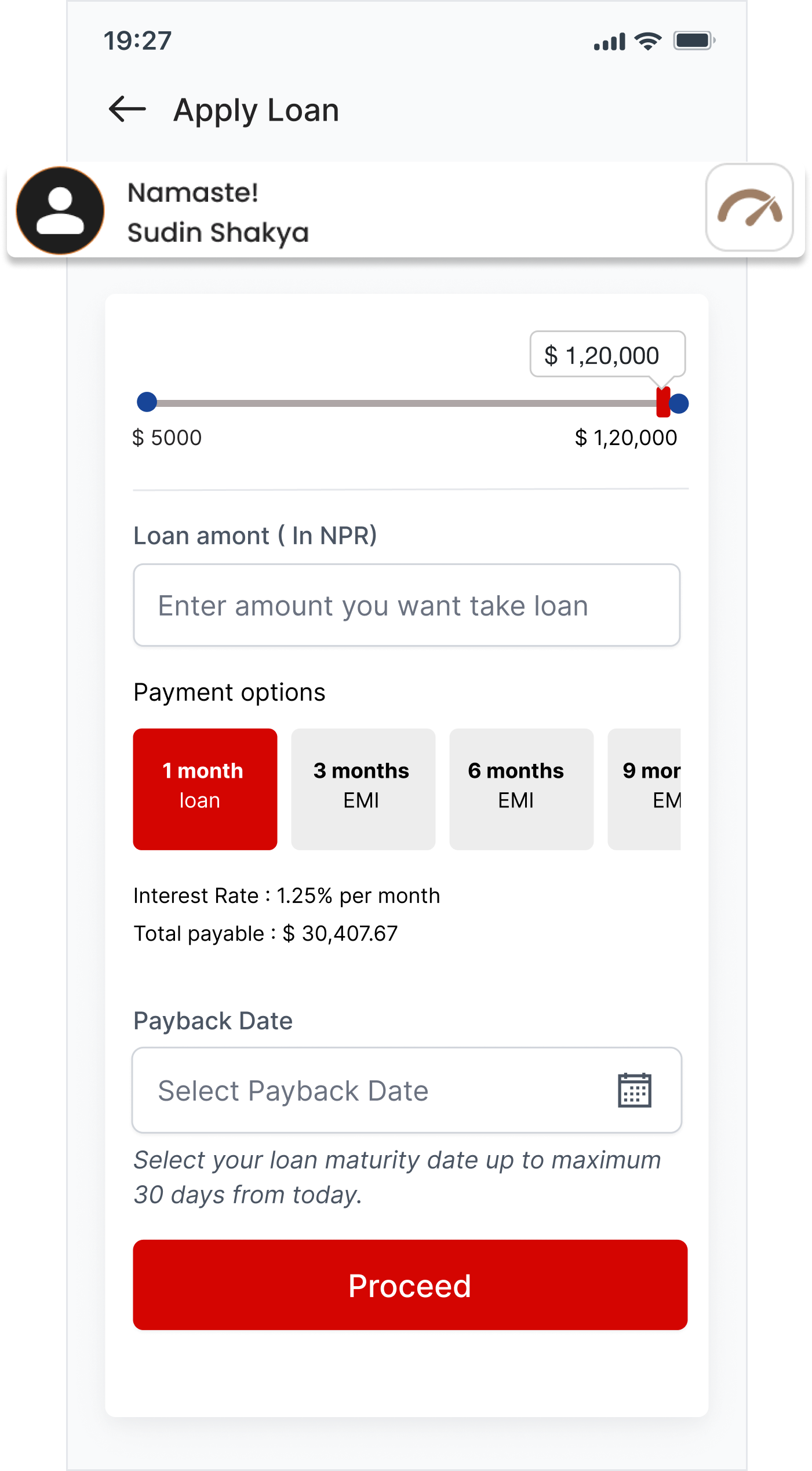

Interbank transactions

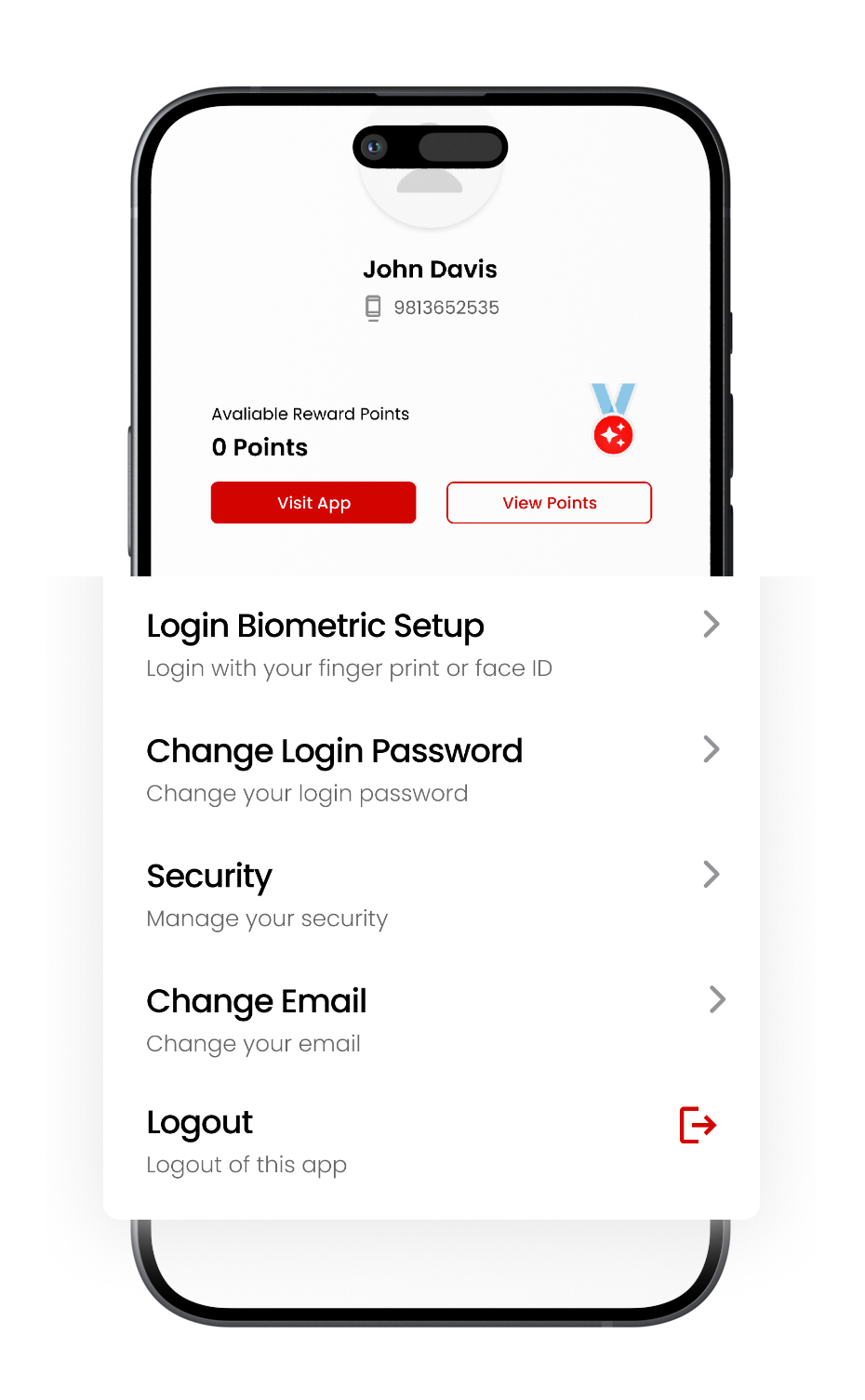

Digital Inclusion