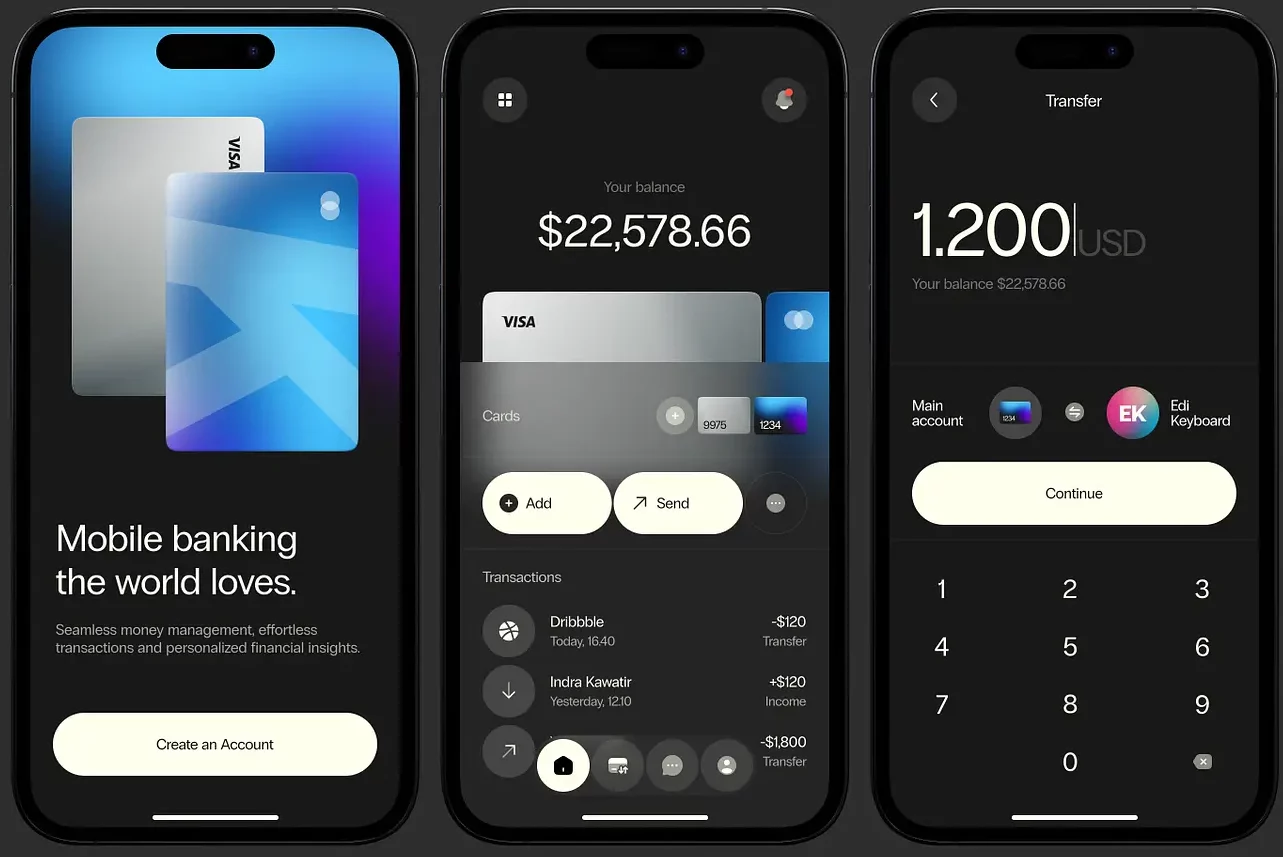

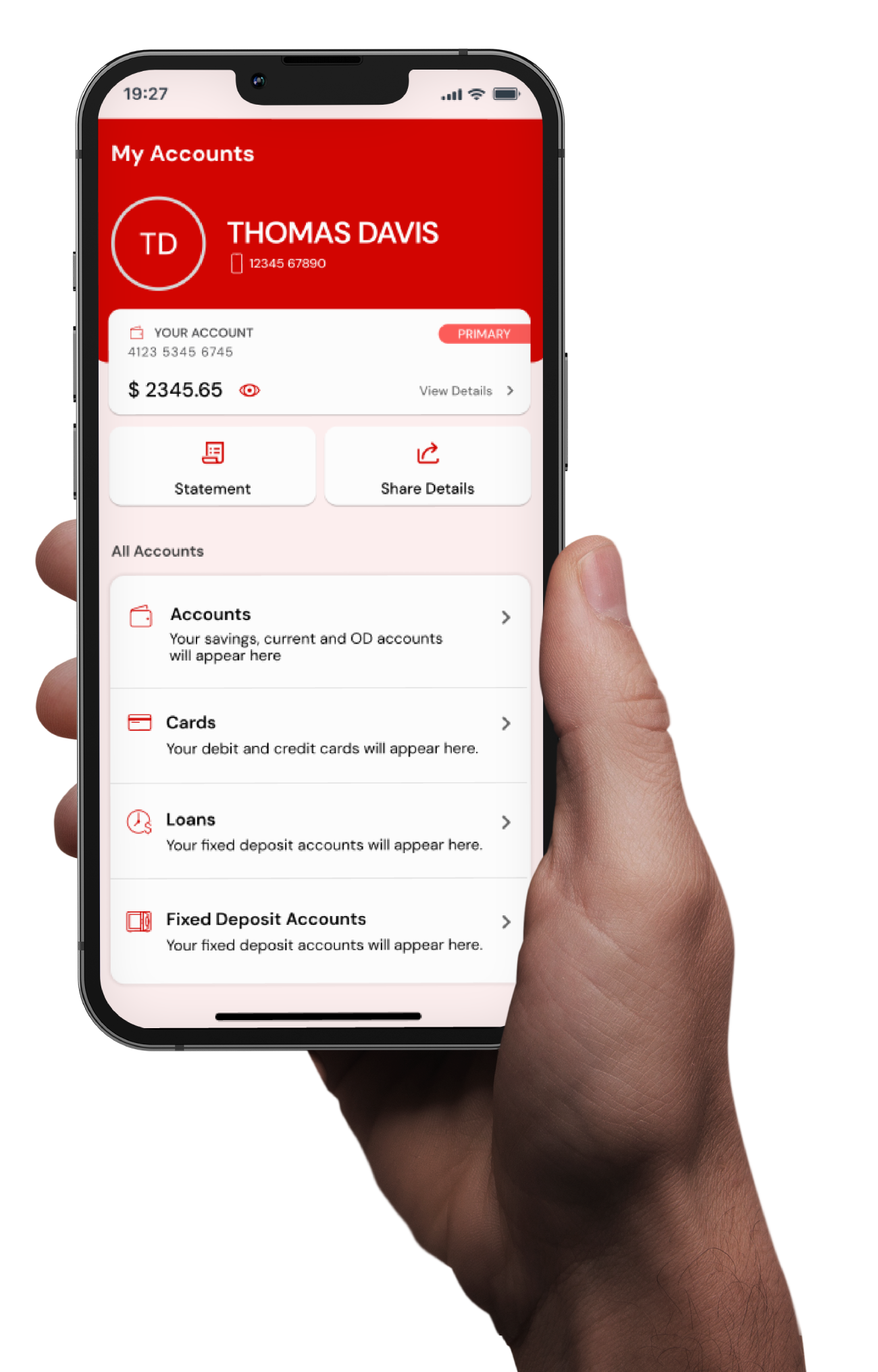

We redefine traditional banking with our next-gen banking solutions that puts customers at the heart of operations.

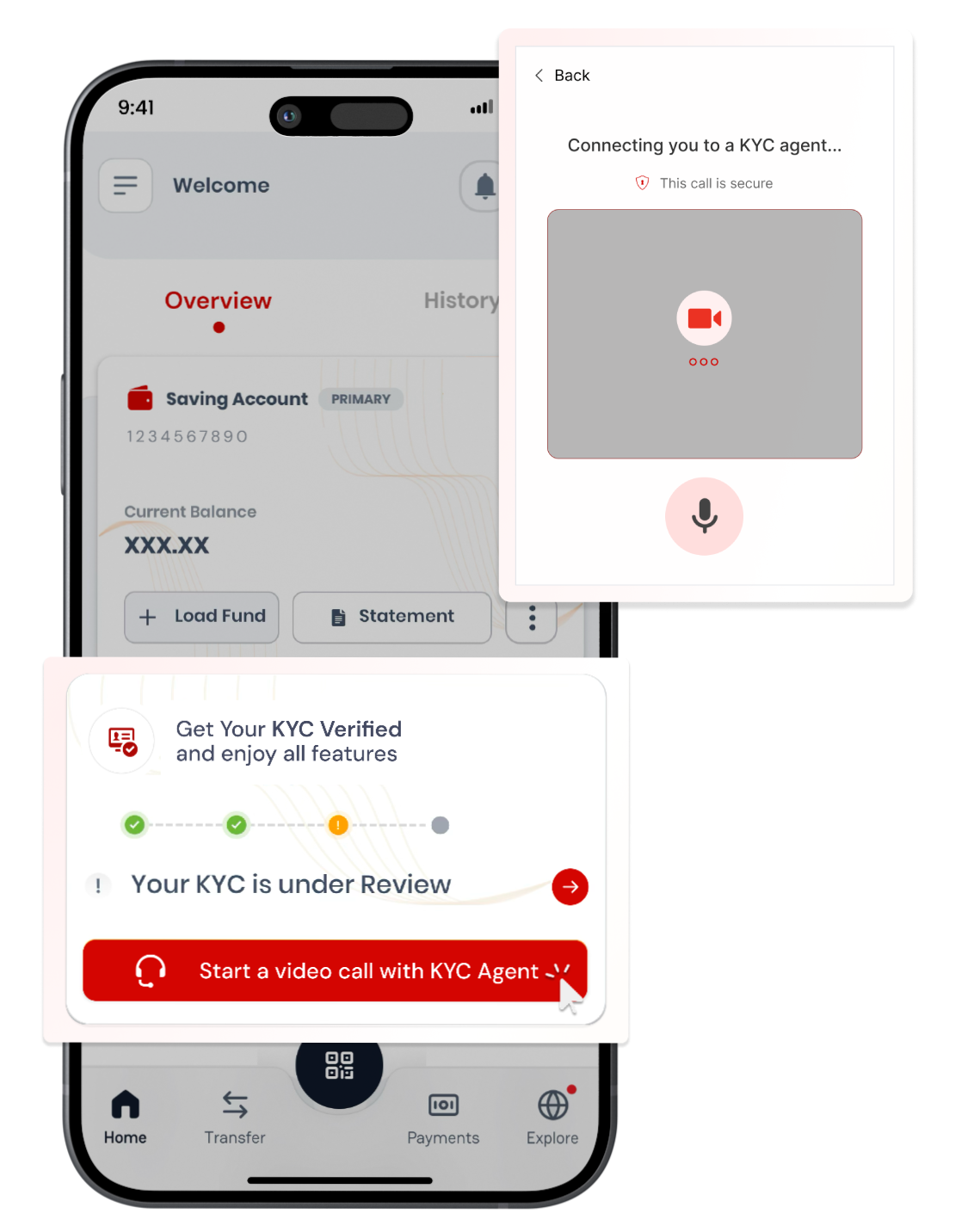

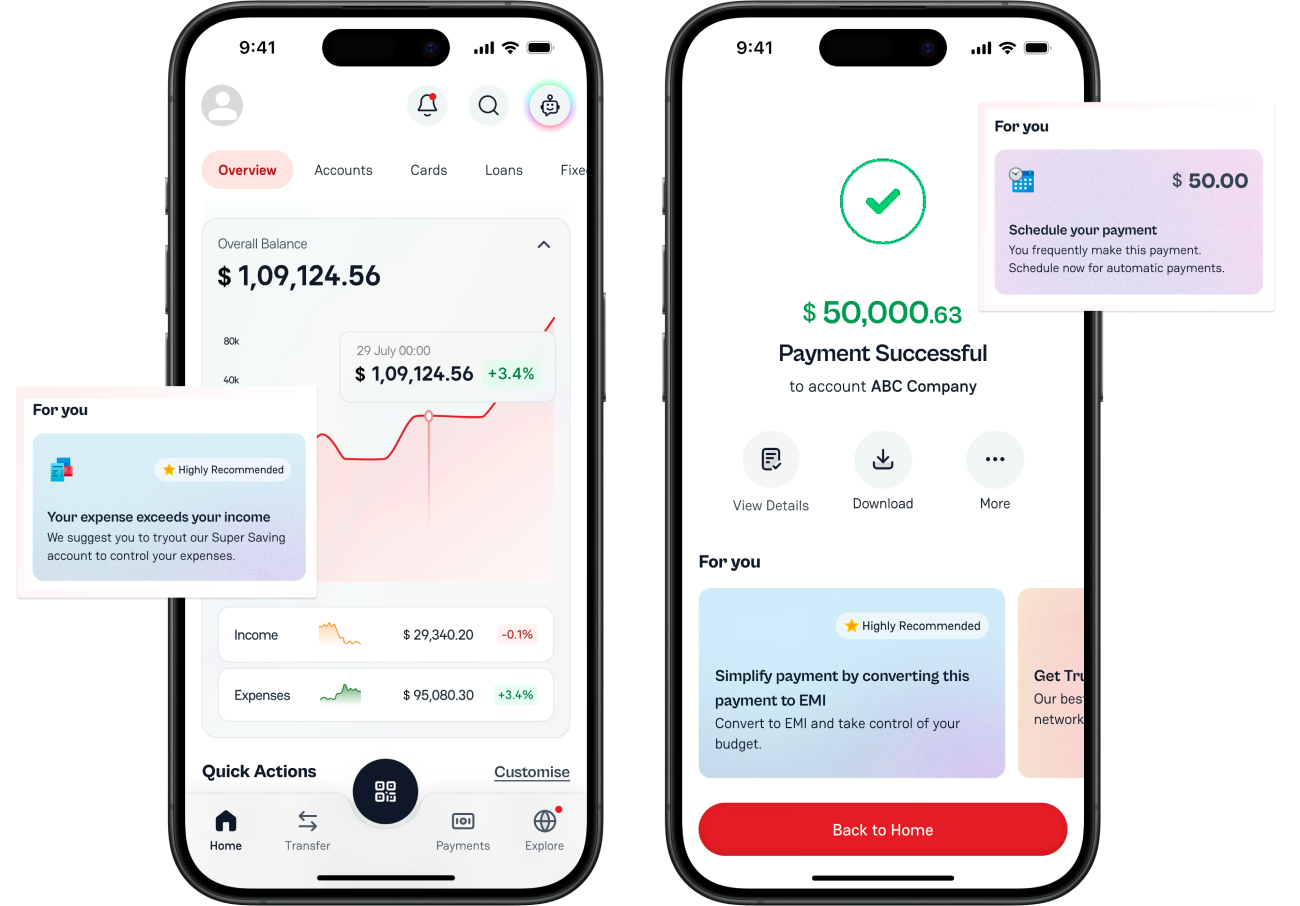

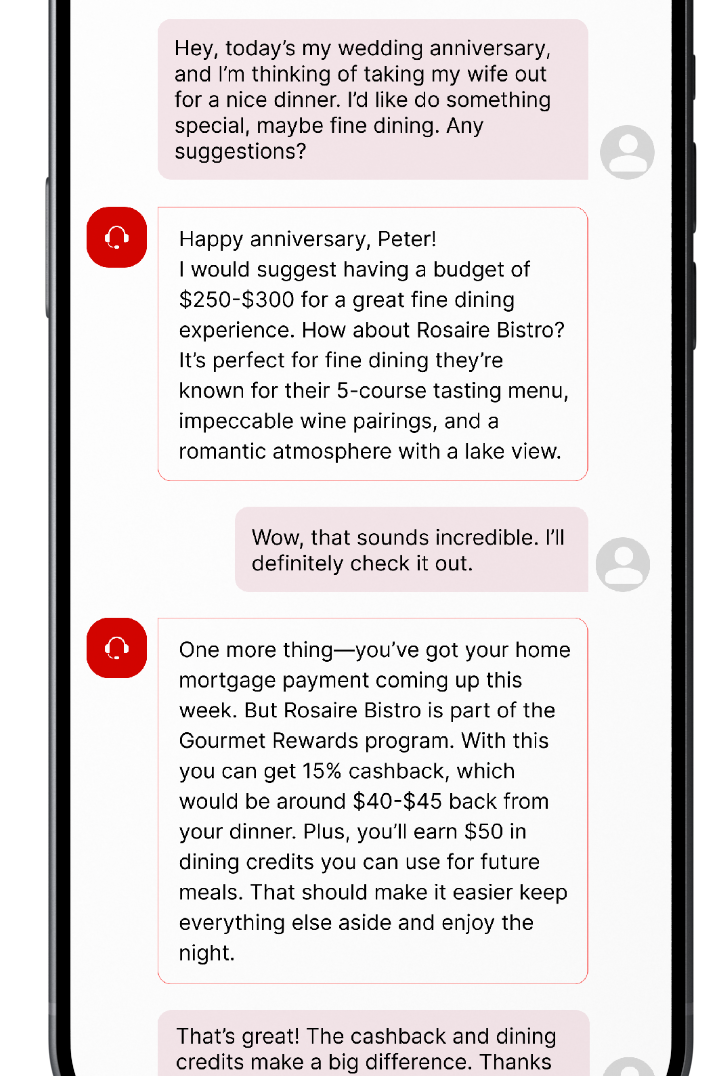

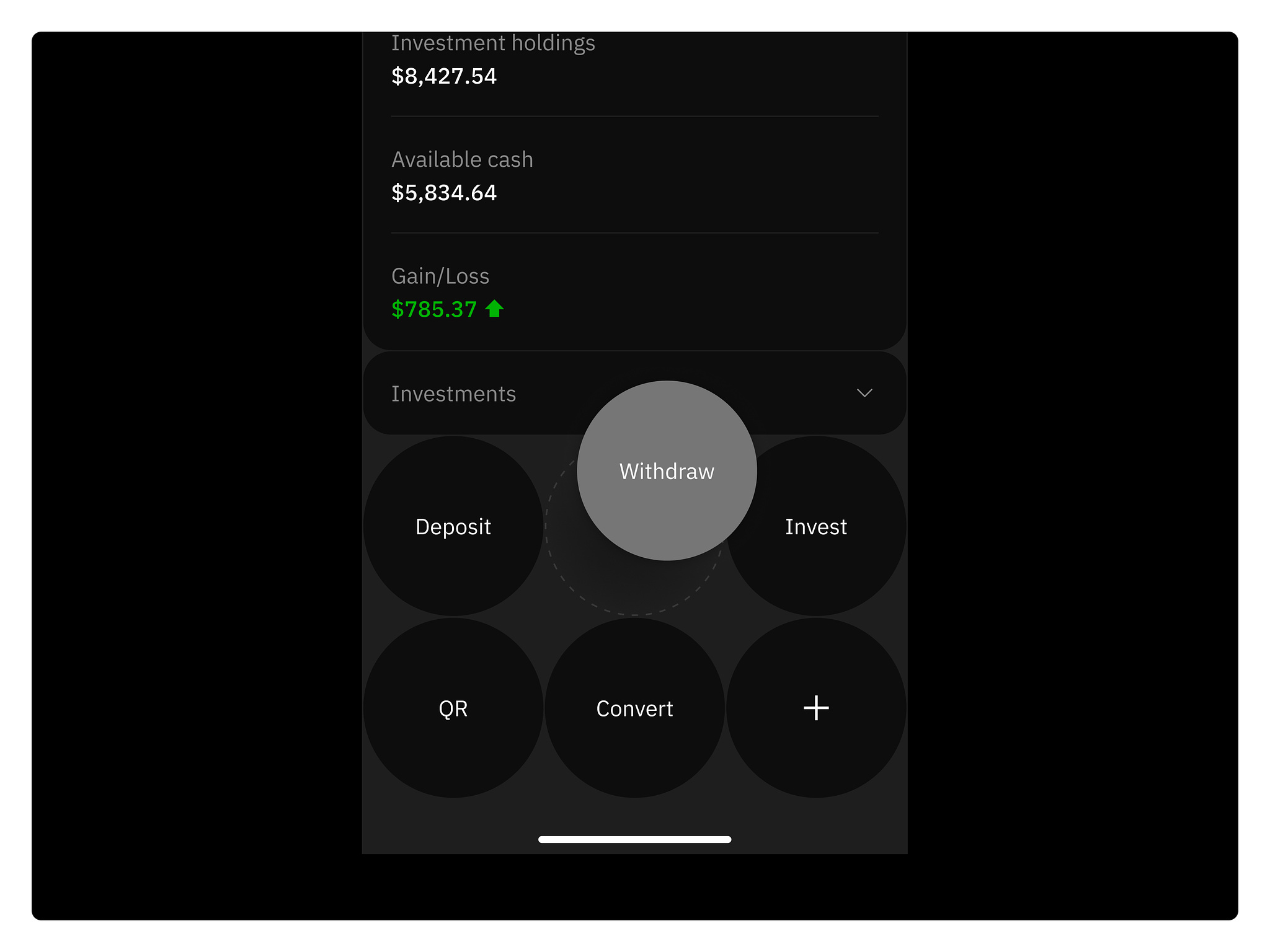

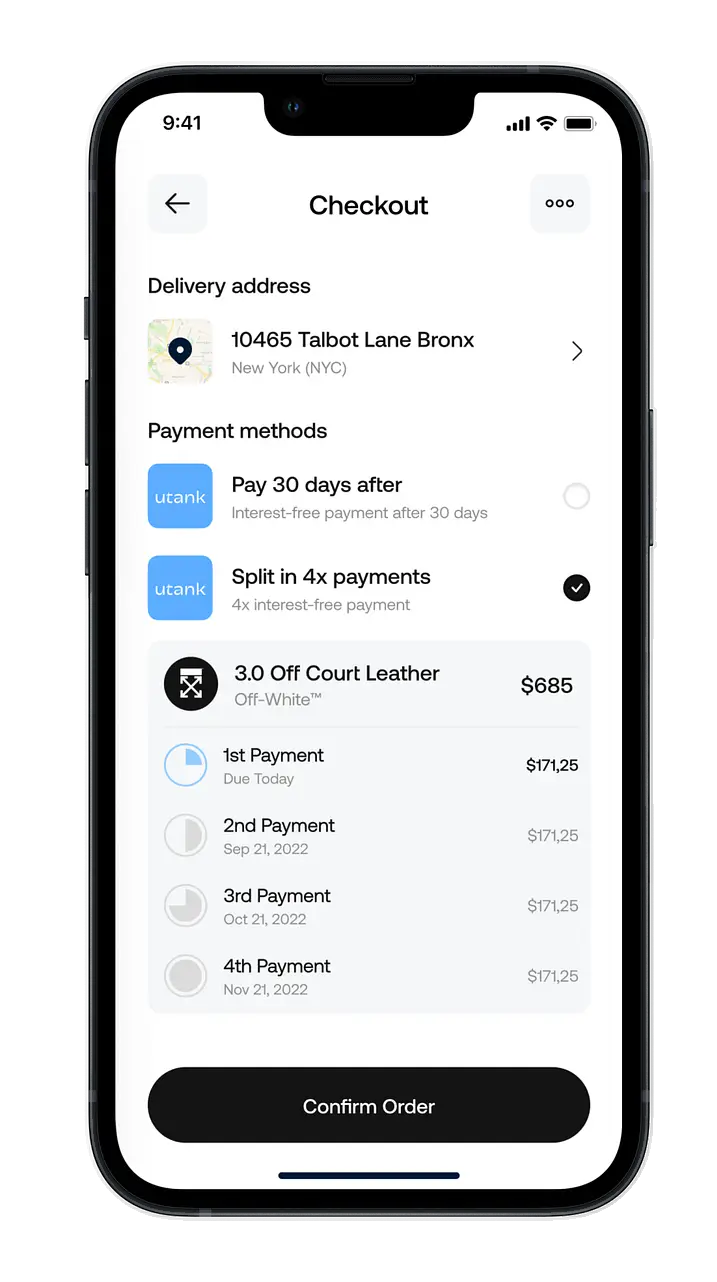

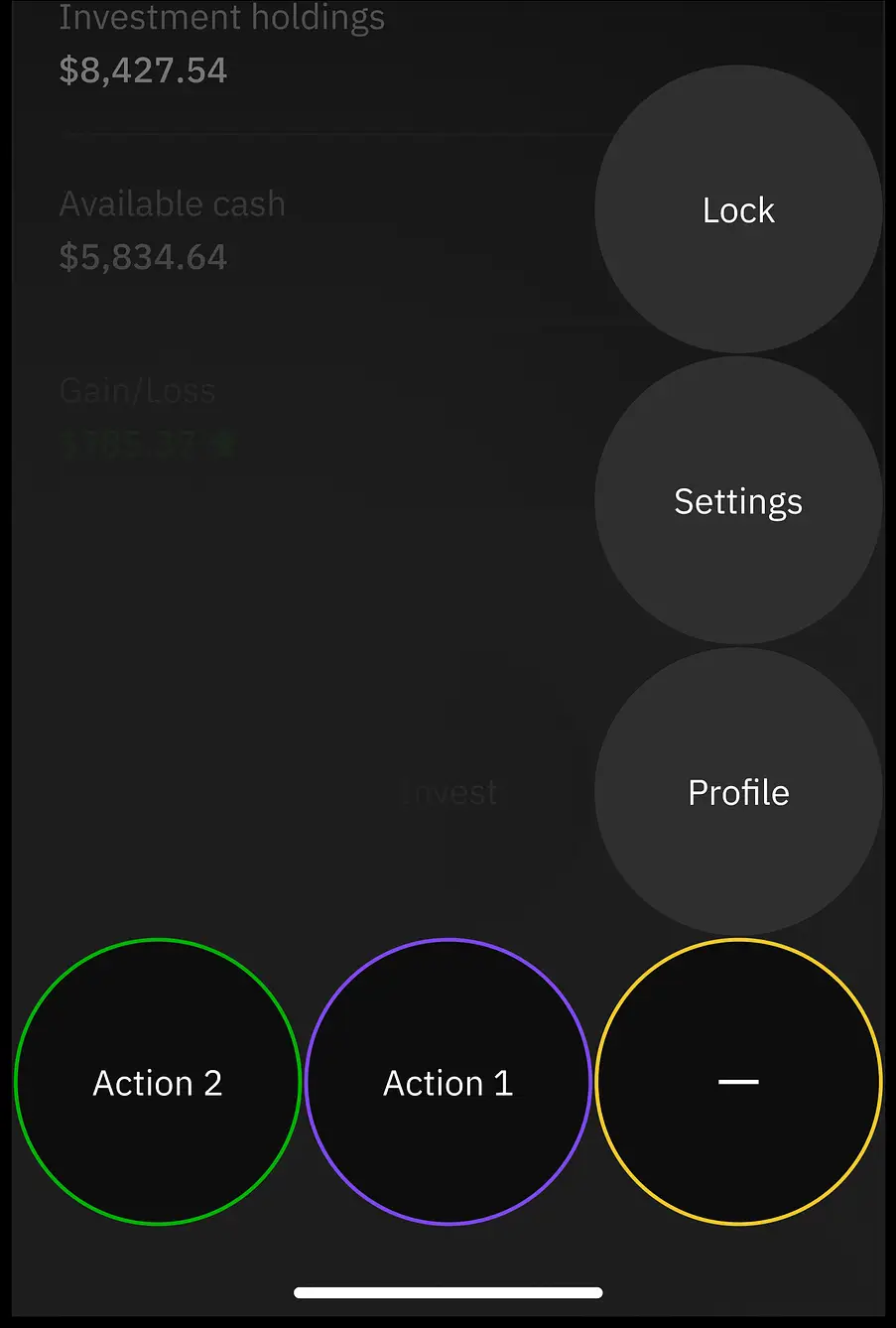

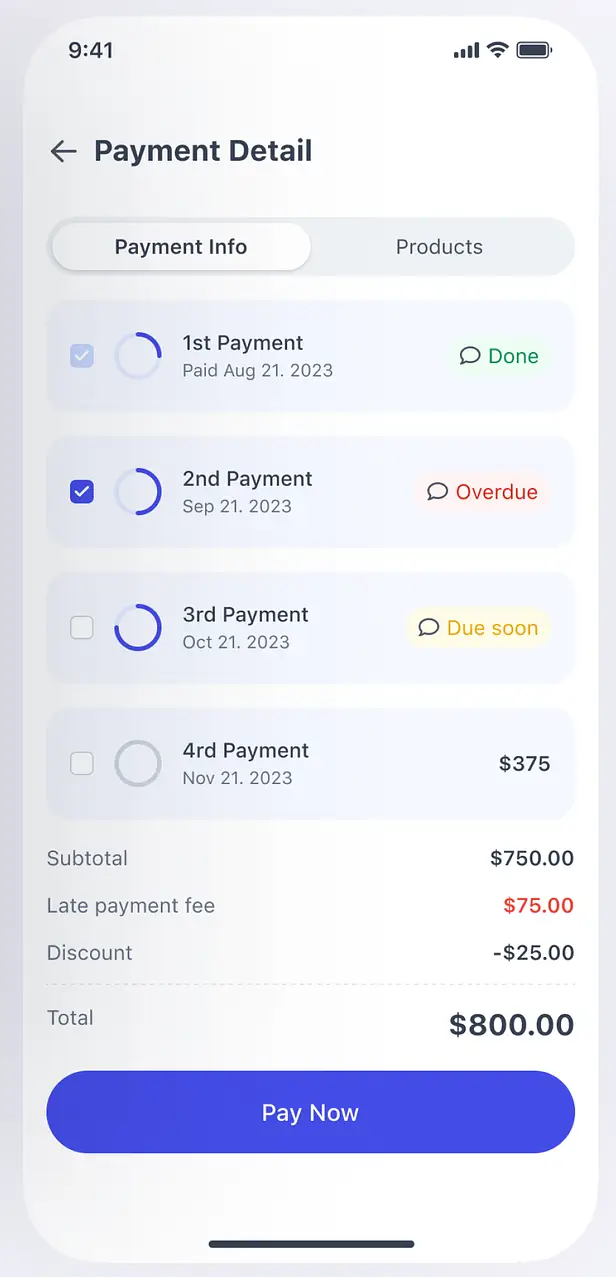

By deploying proprietary technology we offer a suite of digital banking features like real-time risk analysis, AI-driven contextual and personalised banking experience.