The banking industry is undergoing a digital revolution, driven by technological advancements and evolving customer expectations. Traditional brick-and-mortar branches, once the cornerstone of customer engagement, are being complemented—and in some cases, replaced—by virtual branches. These digital counterparts are redefining customer engagement in modern banking, offering enhanced convenience, personalized experiences, and streamlined services.

The Emergence of Virtual Branches

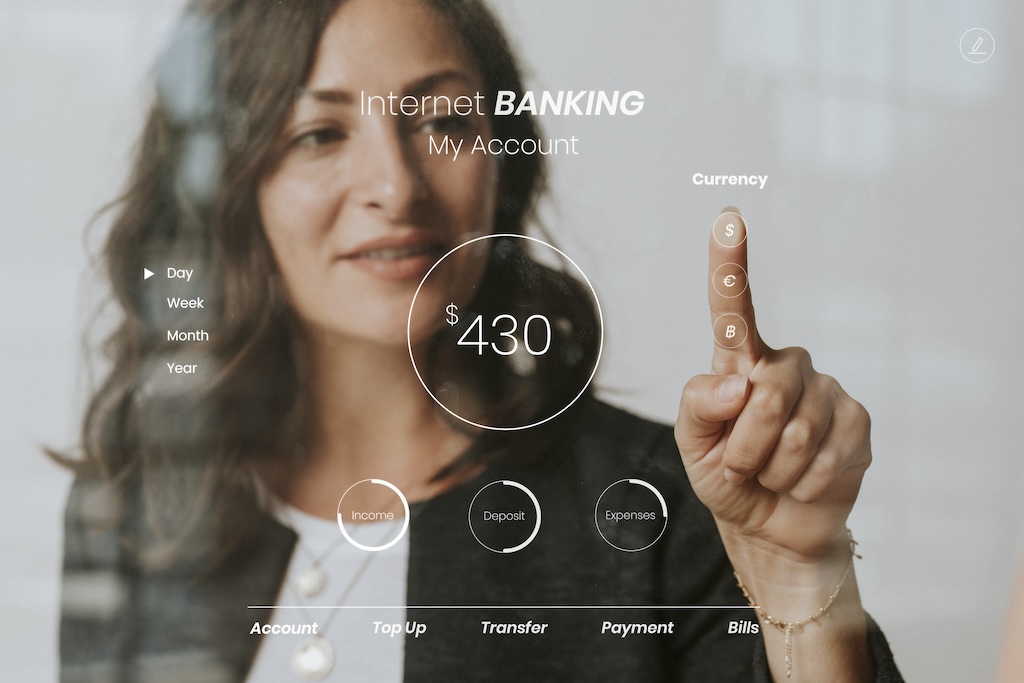

Virtual branches leverage digital platforms to provide banking services that were traditionally offered in physical locations. By utilizing web and mobile applications, virtual branches enable customers to access a wide range of banking services from the comfort of their homes or on the go. This transformation is not just about digitizing services but about creating a seamless, interactive, and engaging banking experience.

Key Benefits of Virtual Branches

- Convenience and Accessibility Virtual branches are accessible 24/7, allowing customers to conduct banking transactions at any time, from anywhere. This convenience is especially valuable for individuals with busy schedules or those living in remote areas where physical branches are scarce. With a virtual branch, banking is no longer constrained by geographical or temporal boundaries.

- Personalized Customer Experience Advanced data analytics and AI technologies enable virtual branches to offer highly personalized experiences. By analyzing customer data, banks can tailor services and recommendations to individual needs and preferences. For example, a customer logging into a virtual branch might receive personalized financial advice, product recommendations, and alerts based on their transaction history and financial goals.

- Cost Efficiency Operating virtual branches significantly reduces overhead costs associated with maintaining physical locations, such as rent, utilities, and staffing. These cost savings can be passed on to customers in the form of lower fees and better interest rates. Additionally, banks can invest in enhancing their digital platforms and expanding their range of services.

- Enhanced Security Virtual branches utilize advanced security measures, including biometric authentication, encryption, and AI-driven fraud detection, to protect customer data and transactions. These technologies provide a higher level of security compared to traditional methods, ensuring that customers can bank with confidence.

- Streamlined Services Virtual branches simplify and expedite banking processes. Customers can open accounts, apply for loans, transfer funds, and manage investments with just a few clicks. Automated systems and AI chatbots handle routine inquiries and transactions, reducing wait times and improving overall efficiency.

Redefining Customer Engagement

Virtual branches are not just about providing digital services; they are about redefining how banks engage with their customers. Here’s how virtual branches are transforming customer engagement:

- Interactive and Engaging Interfaces Virtual branches offer intuitive and user-friendly interfaces that make banking more engaging. Features like video banking, live chat support, and interactive tutorials provide a human touch in the digital realm, enhancing the overall customer experience.

- Proactive Communication Through virtual branches, banks can proactively communicate with customers via push notifications, emails, and in-app messages. These communications can include alerts about account activity, reminders for upcoming payments, and personalized offers, ensuring that customers stay informed and engaged.

- Community and Education Virtual branches often incorporate community features and educational resources. Customers can access financial literacy content, join webinars, and participate in online forums. These resources empower customers with the knowledge and tools to make informed financial decisions.

- Feedback and Improvement Digital platforms enable banks to collect real-time feedback from customers. This feedback can be used to continuously improve services and address customer concerns promptly. By actively listening to customers, banks can build stronger relationships and foster loyalty.

The Future of Virtual Branches

The evolution of virtual branches is set to continue as technology advances and customer expectations evolve. Here are some trends shaping the future of virtual branches:

- Integration of Emerging Technologies The integration of technologies such as augmented reality (AR), virtual reality (VR), and the Internet of Things (IoT) will further enhance the virtual banking experience. For instance, AR and VR can create immersive environments for customer interactions, while IoT can enable seamless connectivity between devices for smarter banking solutions.

- Expansion of Services Virtual branches will continue to expand their range of services, offering more comprehensive financial solutions. This includes everything from personalized investment advice and robo-advisors to seamless integration with other financial tools and services.

- Sustainable Banking By reducing the need for physical infrastructure, virtual branches contribute to sustainability efforts. Banks can leverage digital platforms to promote green banking practices, such as paperless statements and eco-friendly investment options.

- Increased Inclusivity Virtual branches have the potential to increase financial inclusivity by reaching underserved populations. By providing easy access to banking services, virtual branches can empower individuals in rural and low-income areas, fostering greater economic participation and growth.

Conclusion

Virtual branches are revolutionizing customer engagement in modern banking by offering unparalleled convenience, personalization, and efficiency. As these digital platforms continue to evolve, they will play an increasingly vital role in shaping the future of banking. By embracing virtual branches, banks can create a more inclusive, engaging, and sustainable banking environment that meets the diverse needs of their customers. The shift towards virtual branches is not just a technological advancement but a transformative journey towards a more connected and empowered financial world.