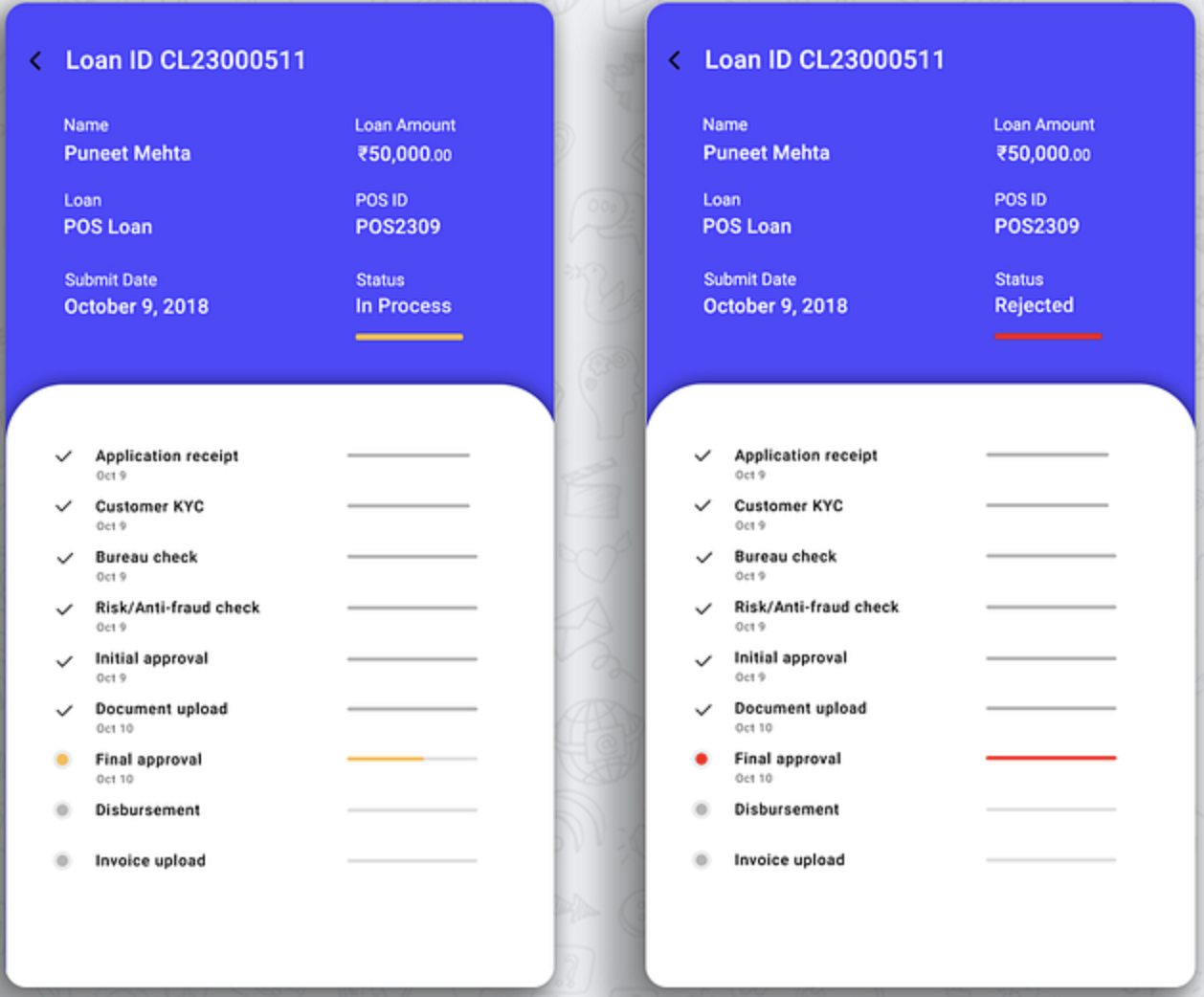

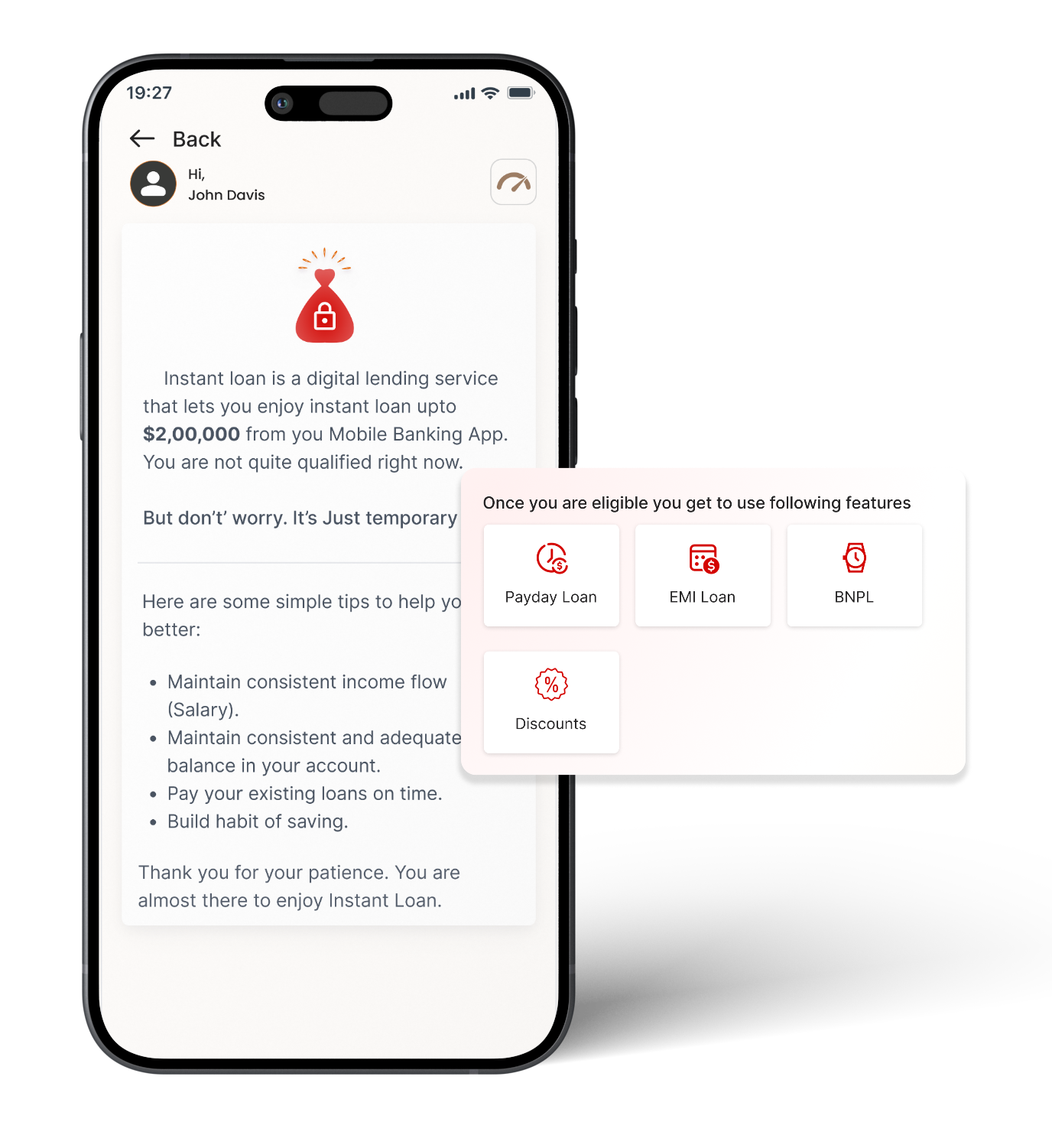

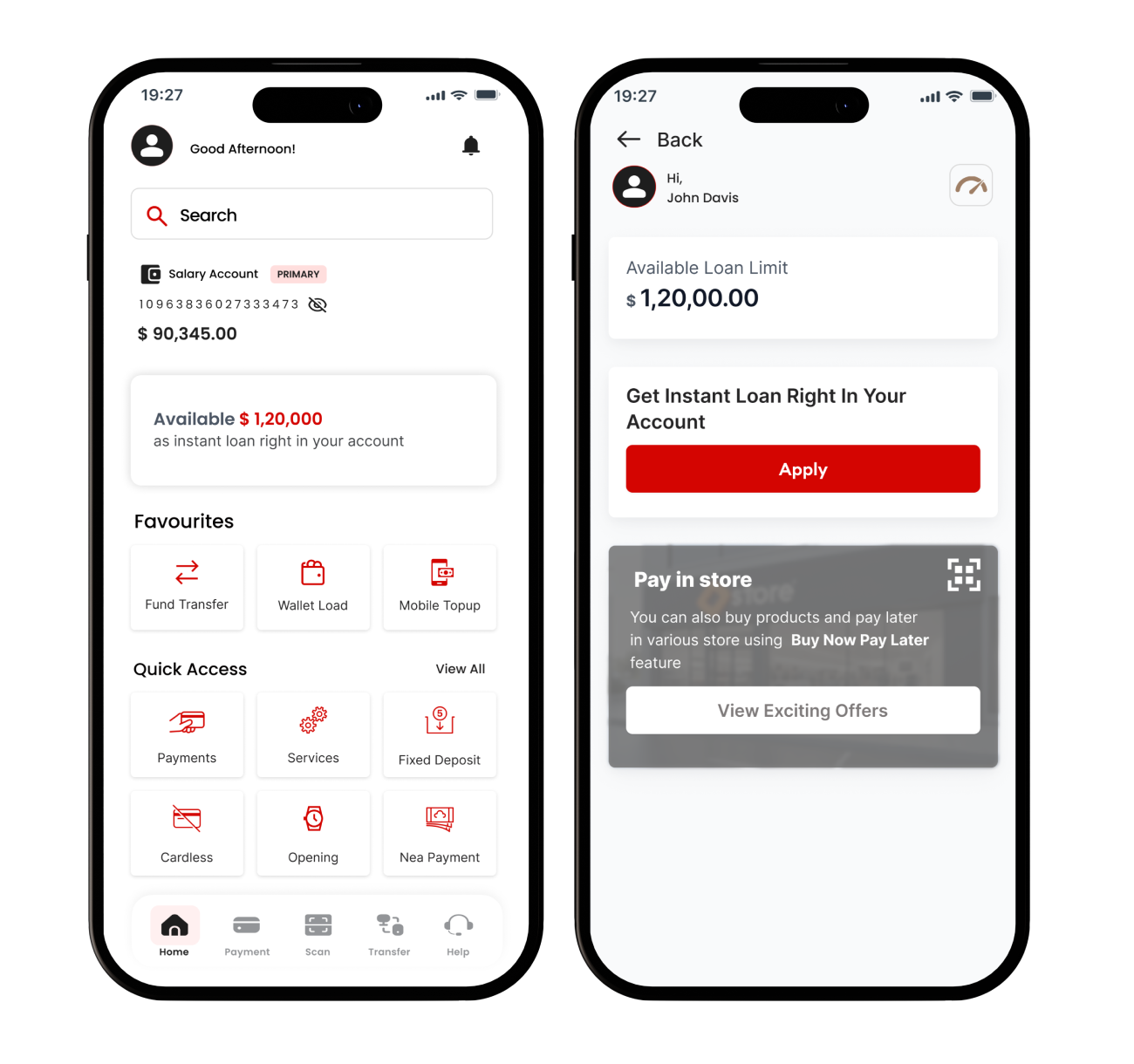

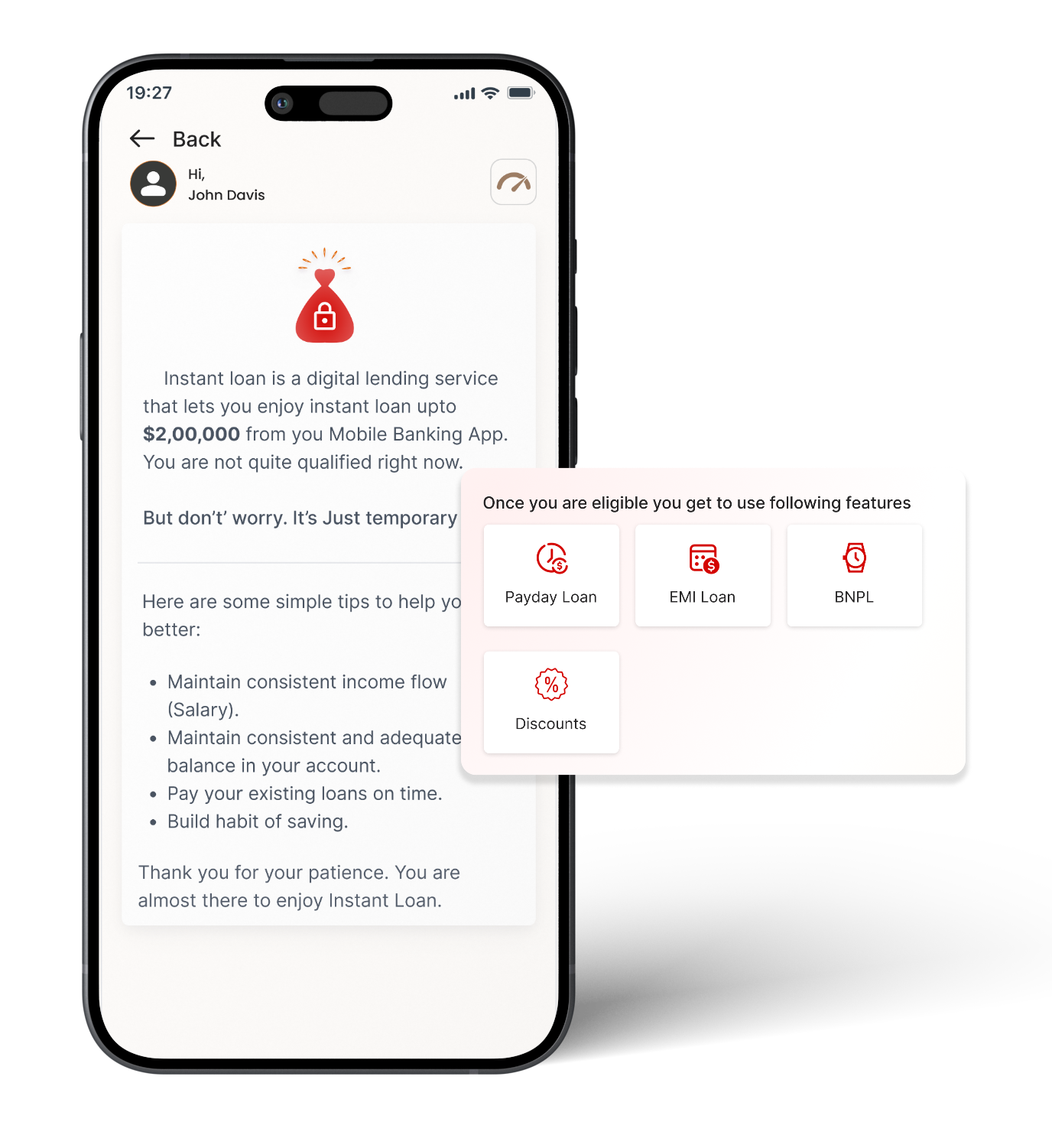

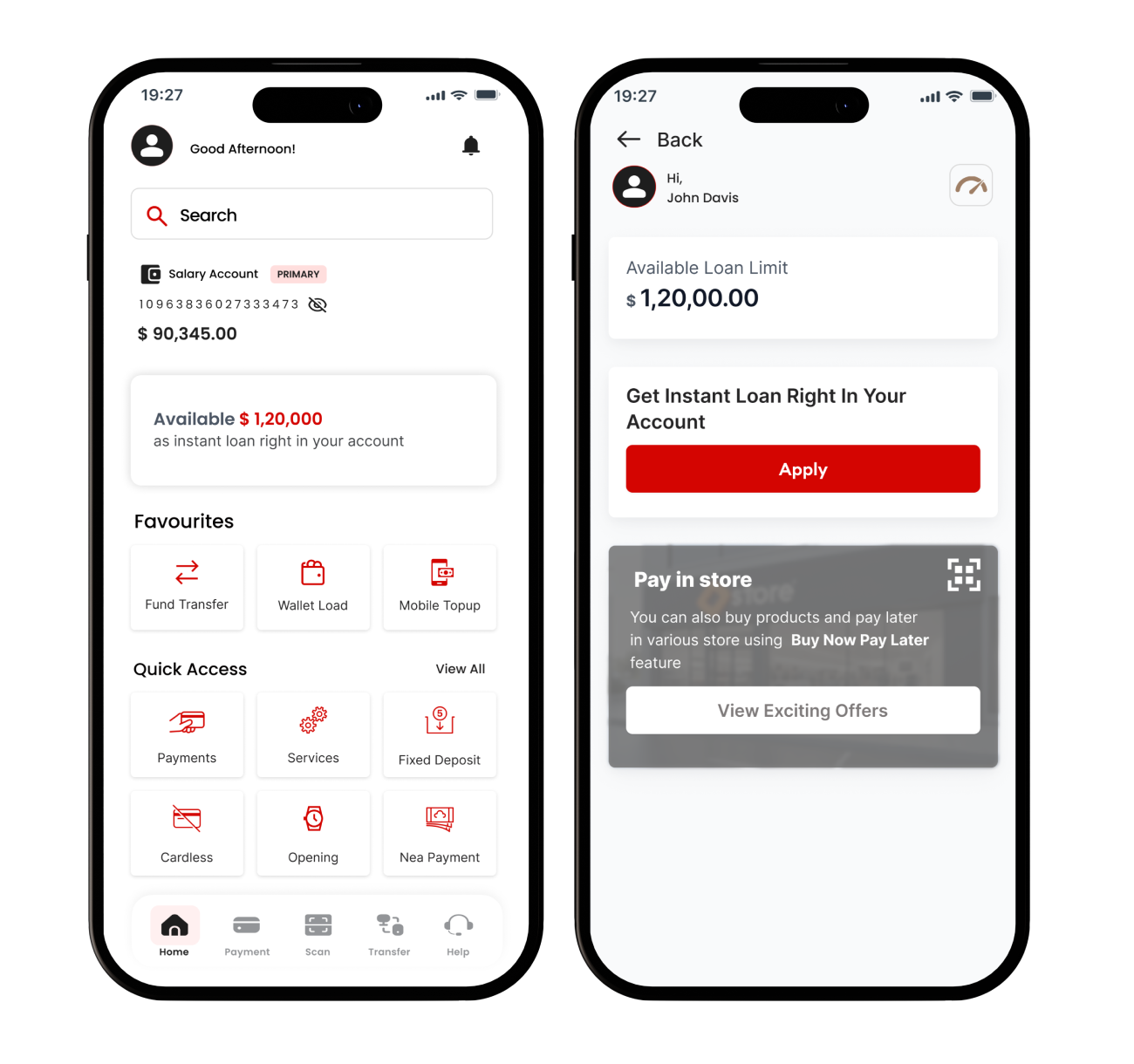

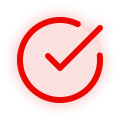

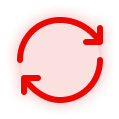

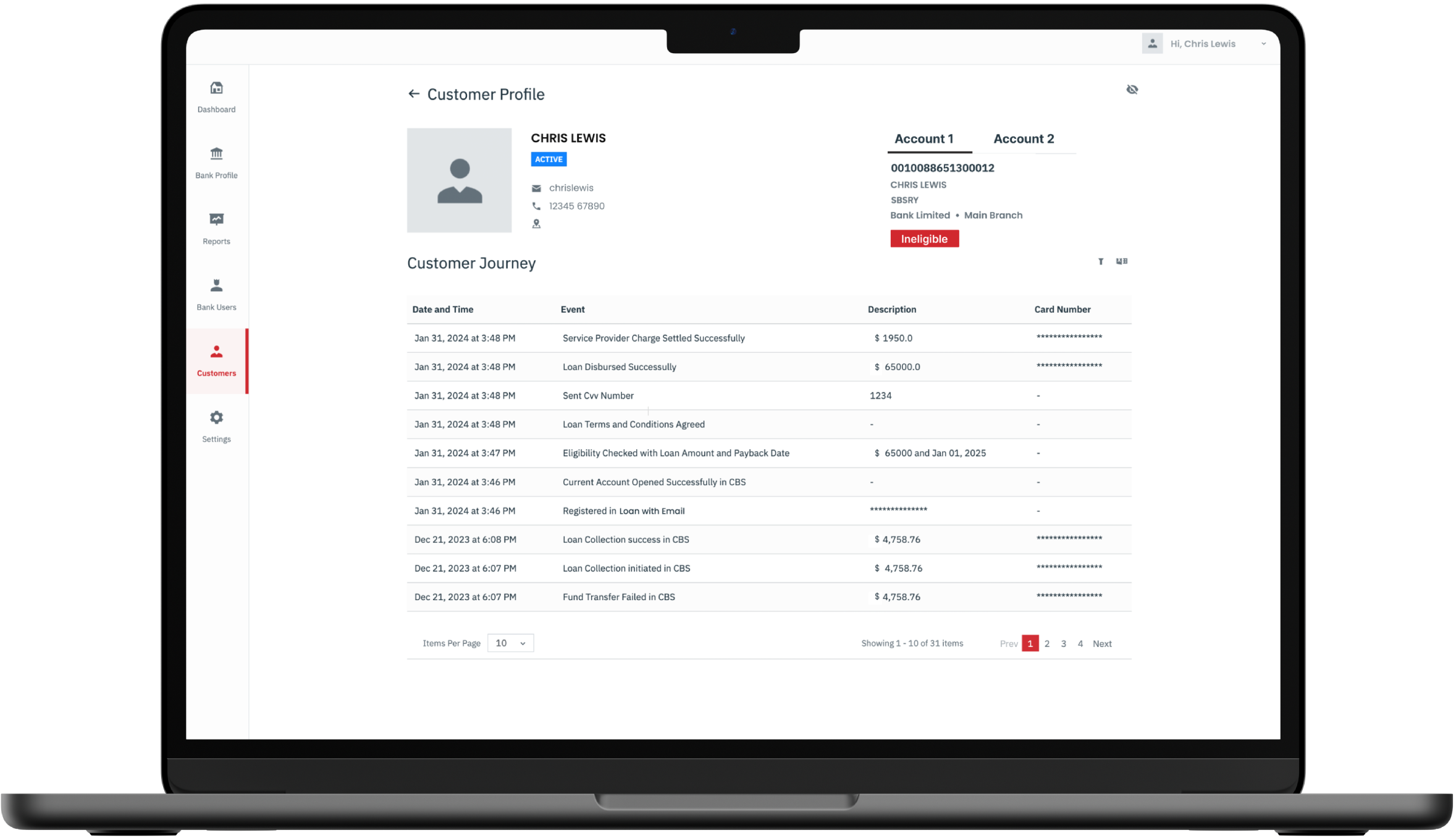

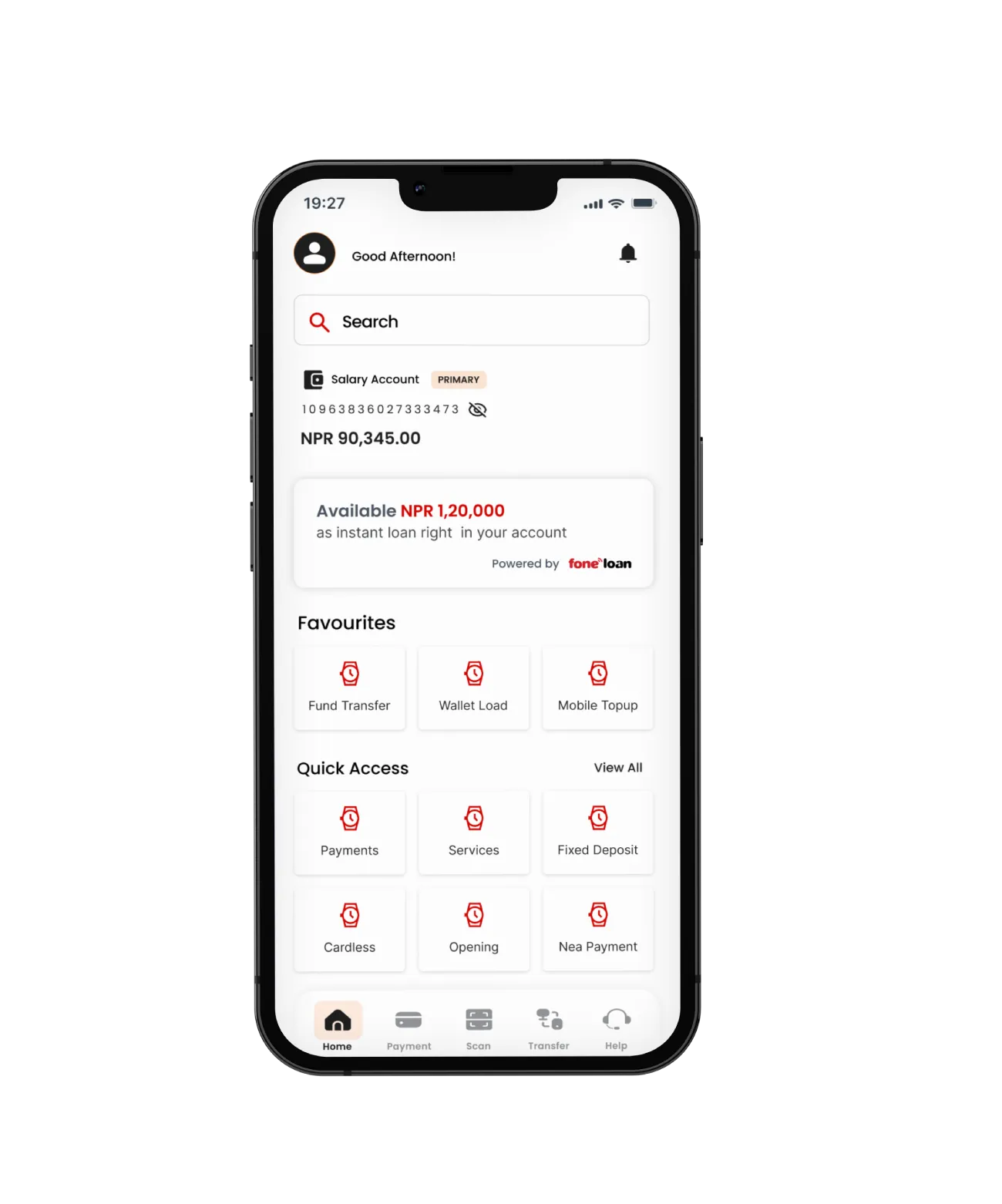

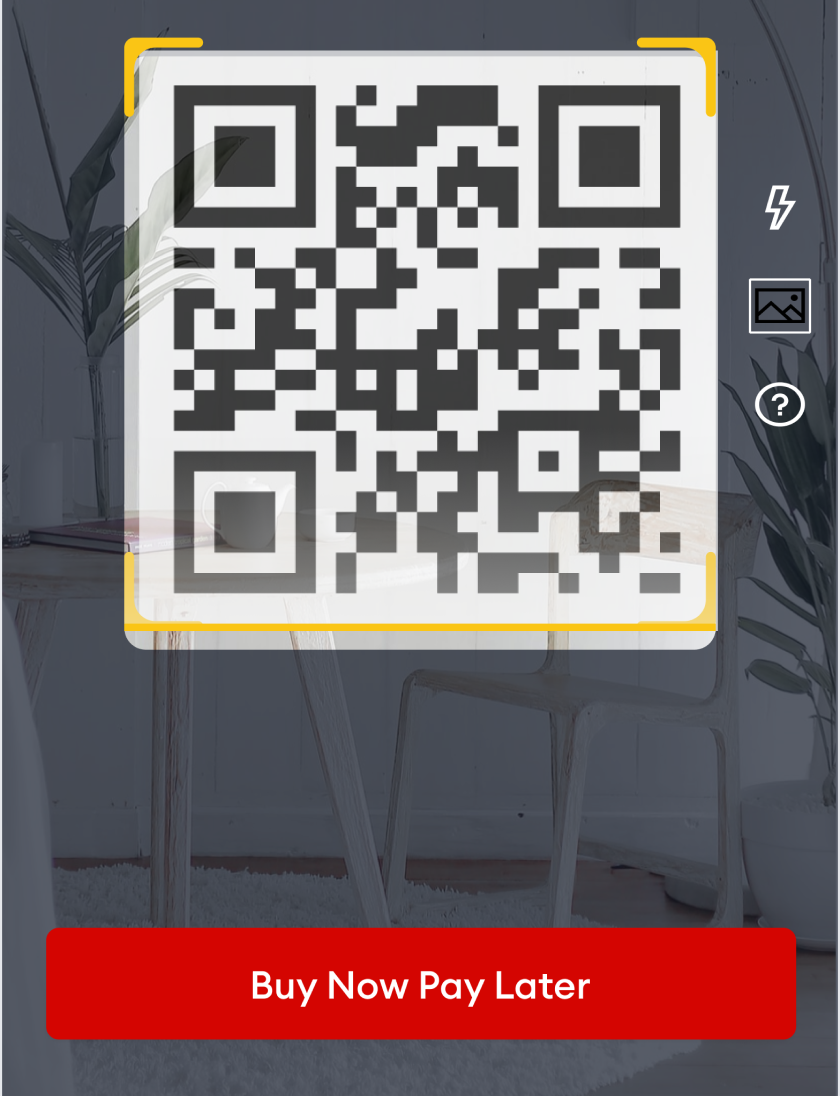

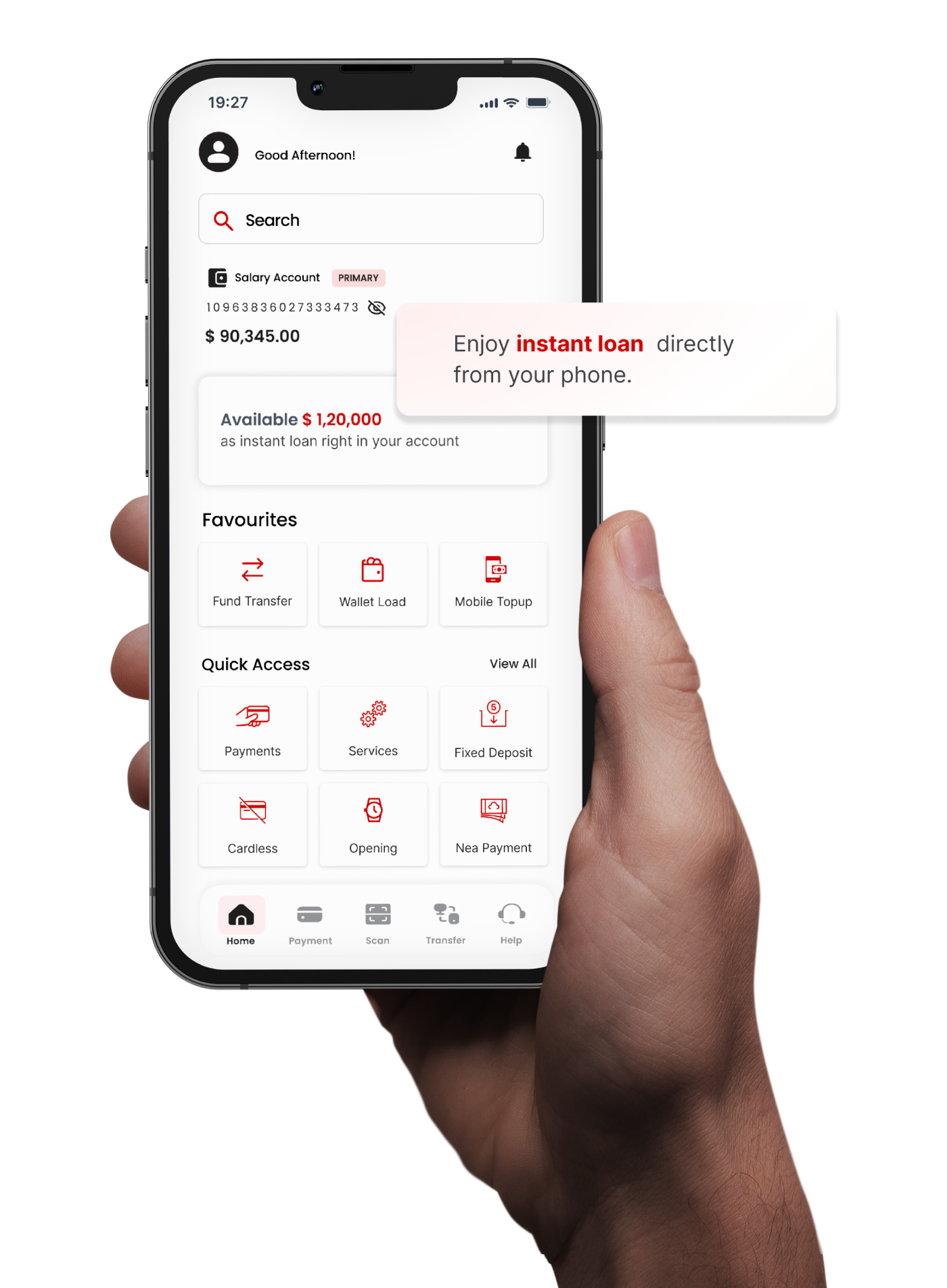

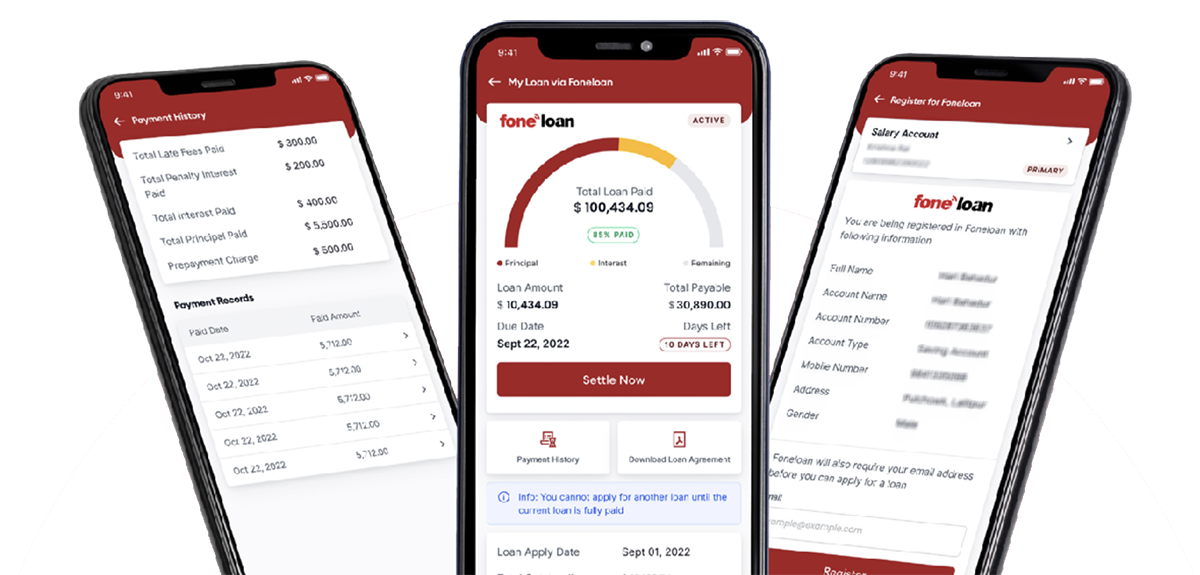

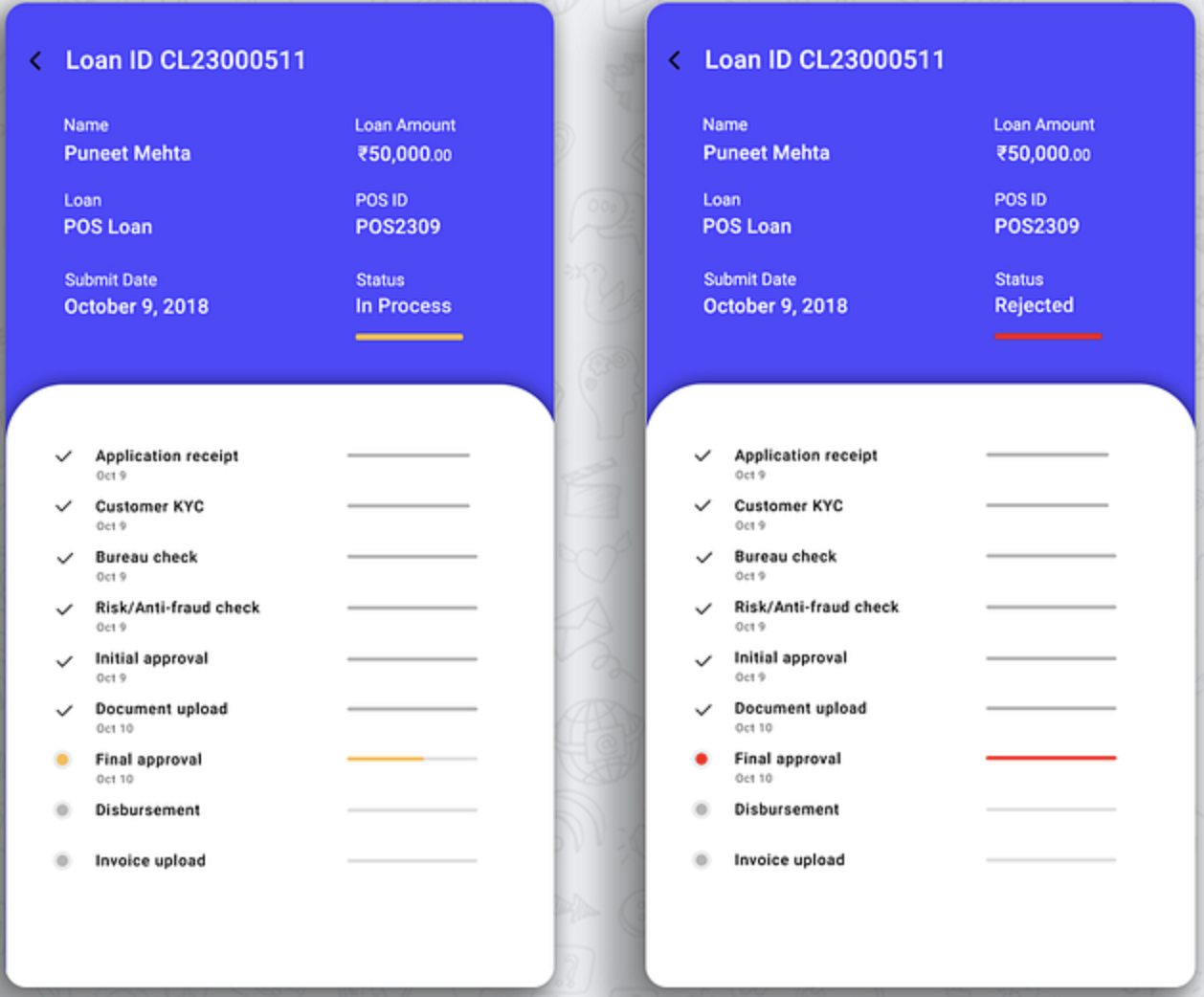

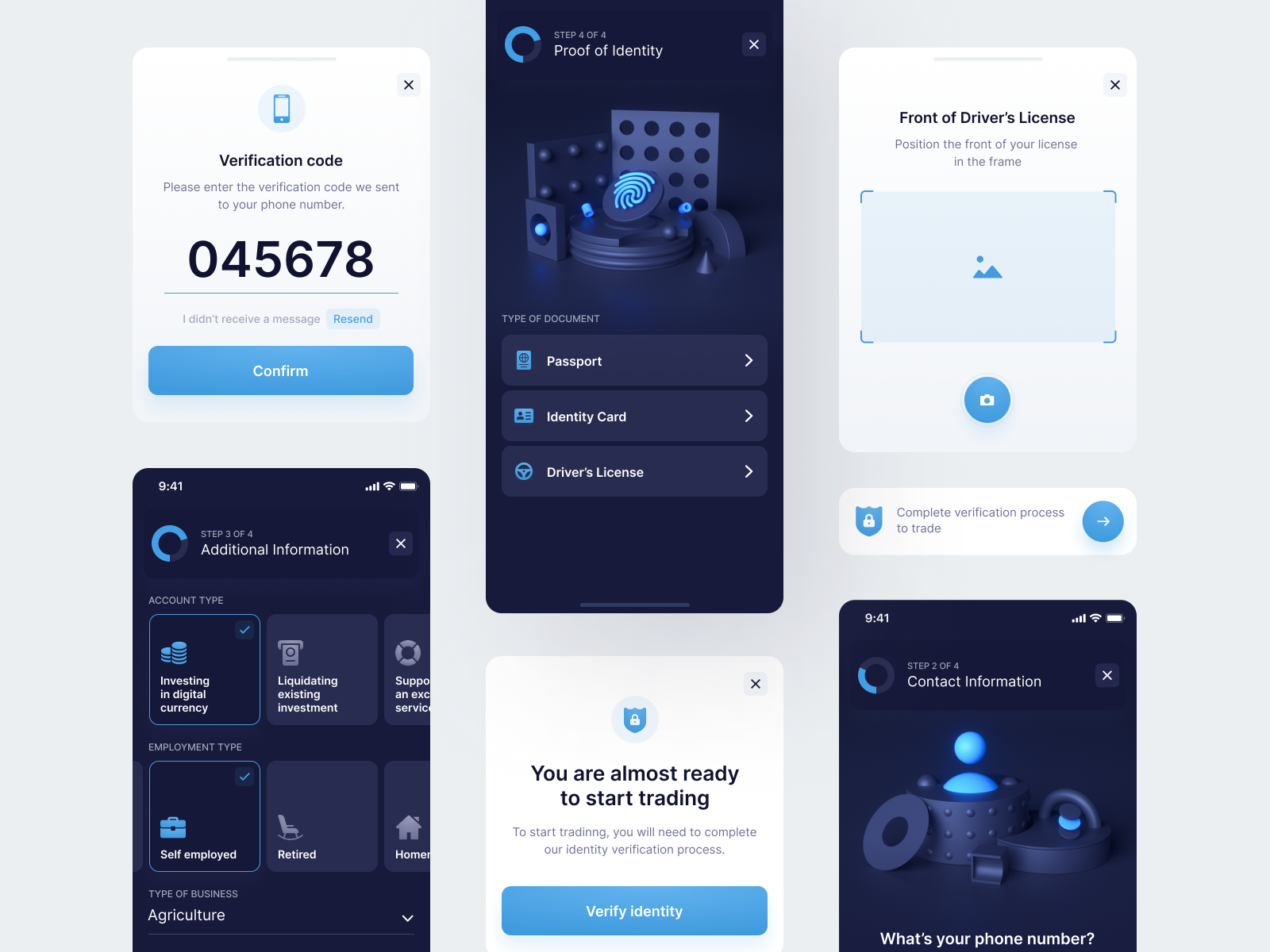

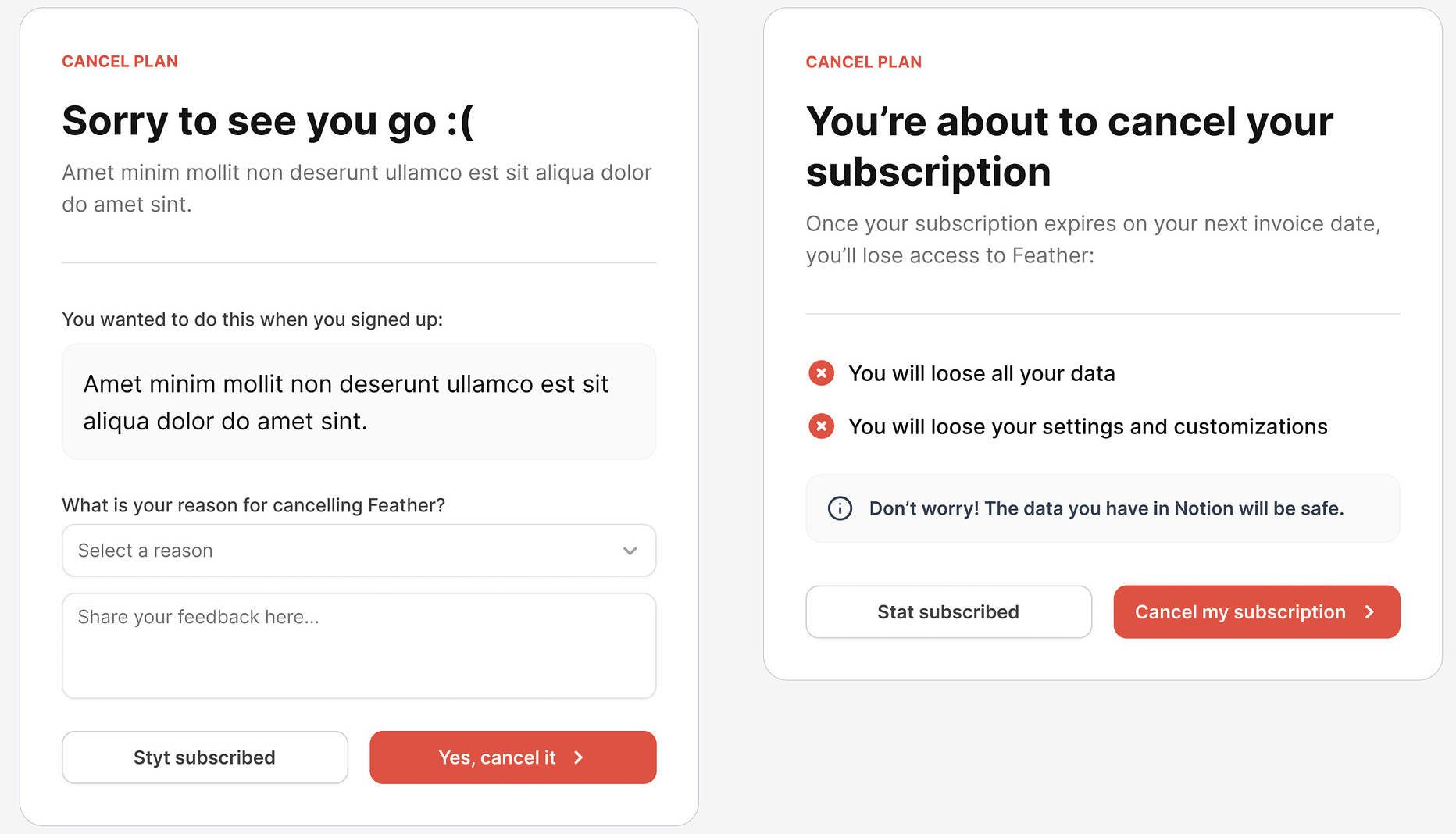

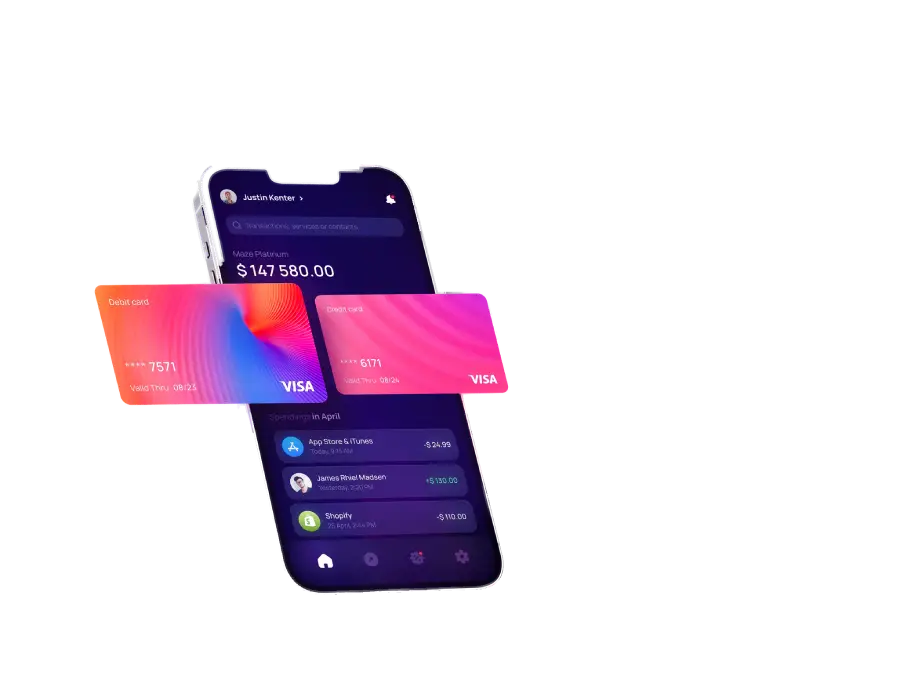

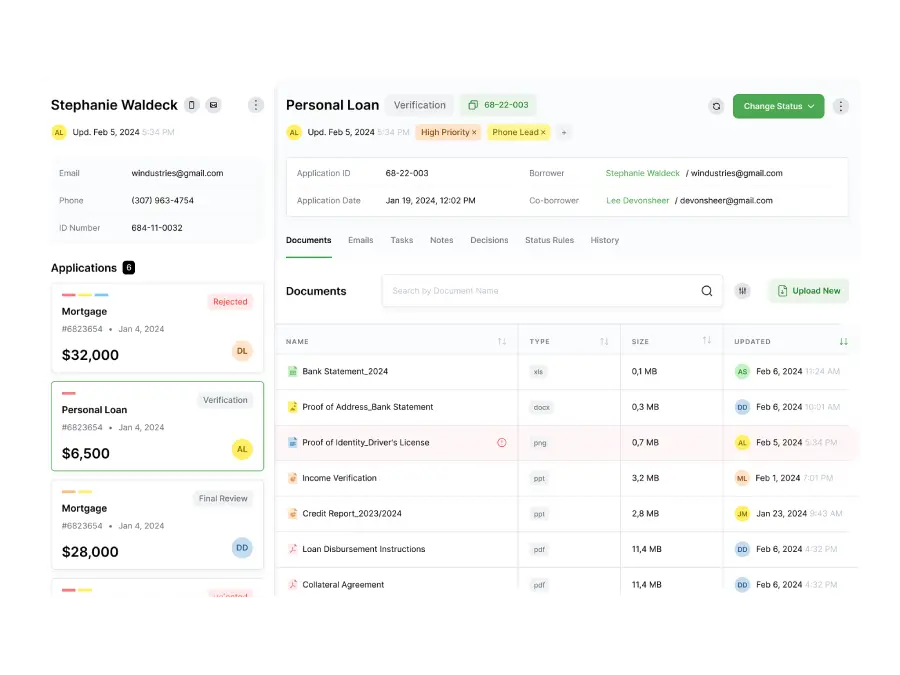

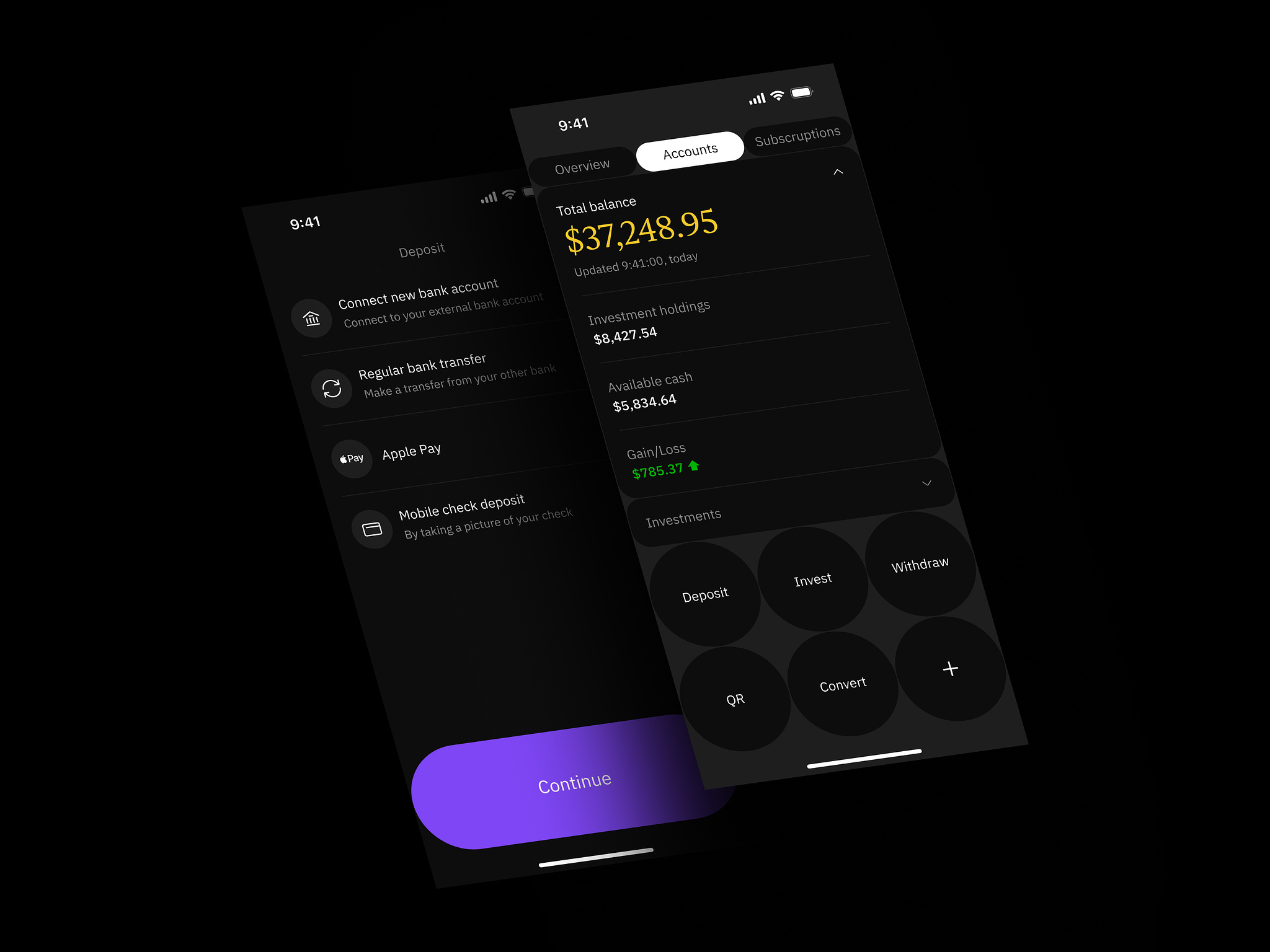

Minimize risk significantly with a fully automated loan management system that scales according to your customer needs without manual intervention. Our offer is a highly customizable solution that allows for fine adjustments and is completely self-sustaining once set up.

Minimize risk significantly with a fully automated loan management system that scales according to your customer needs without manual intervention. Our offer is a highly customizable solution that allows for fine adjustments and is completely self-sustaining once set up.

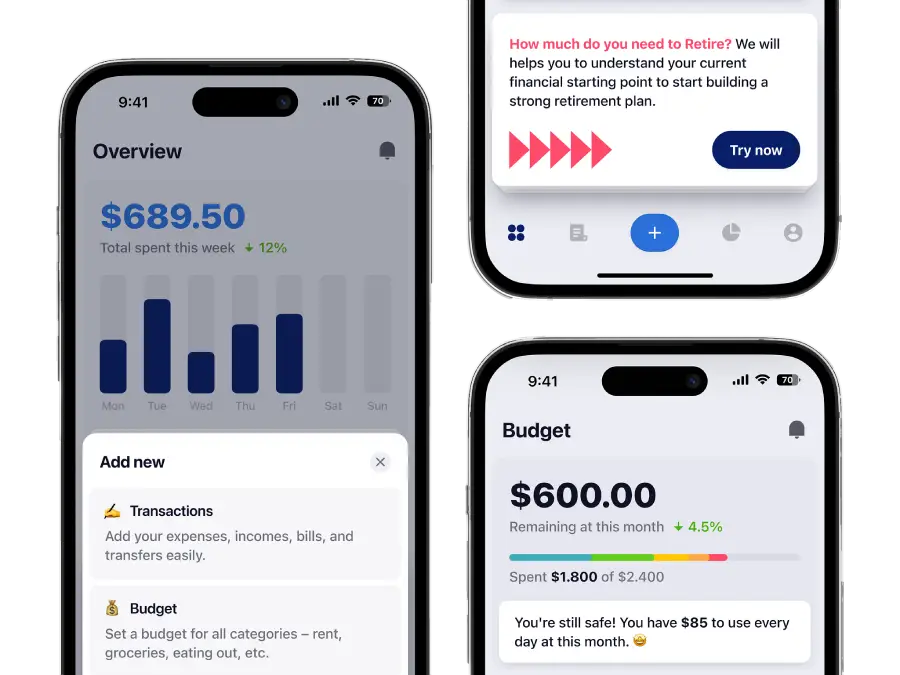

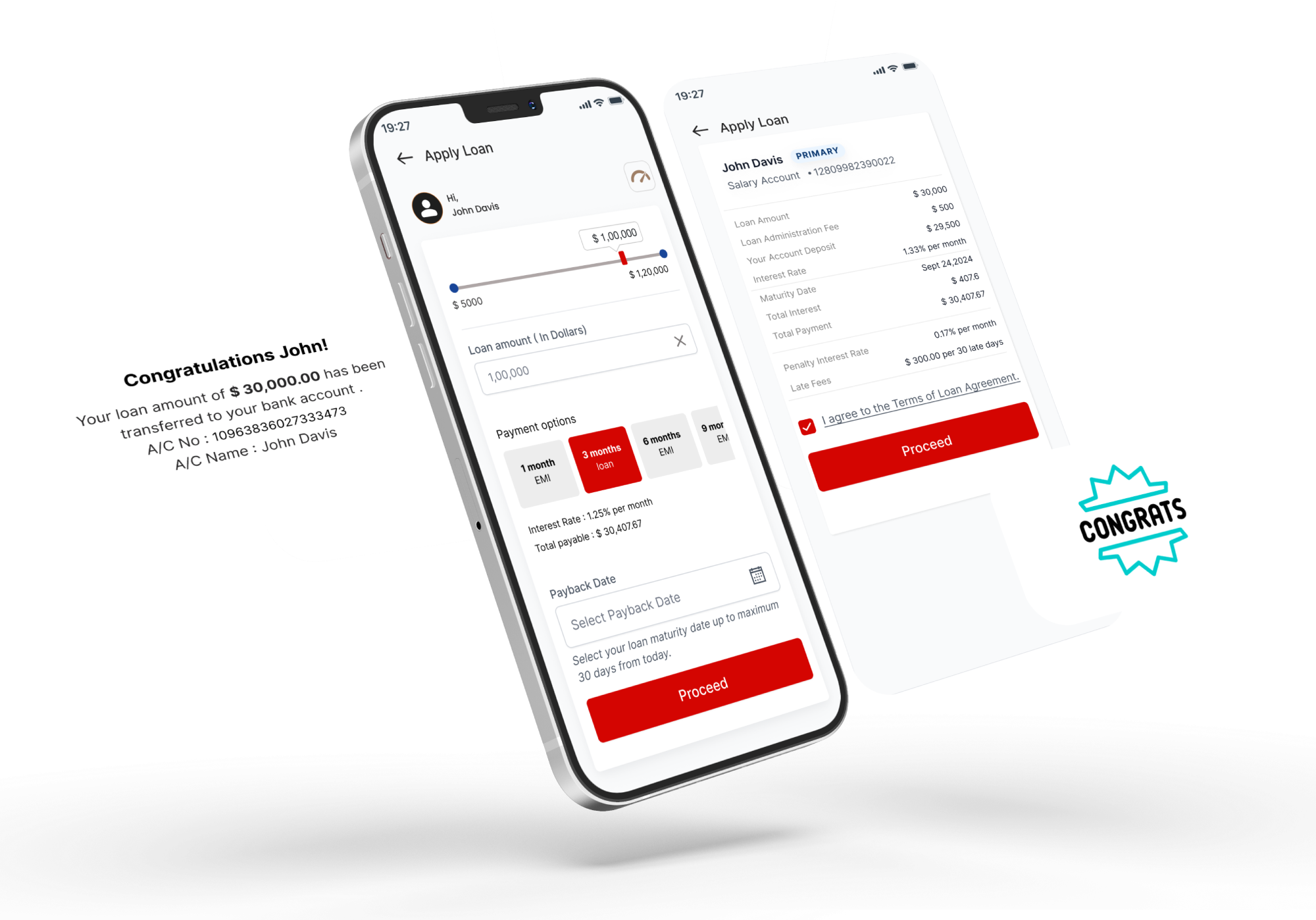

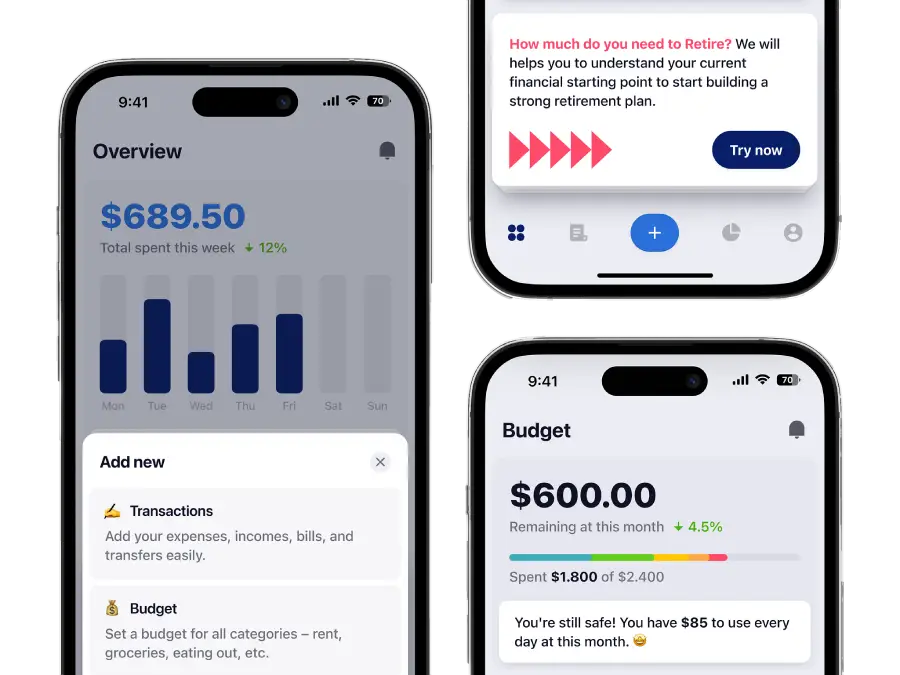

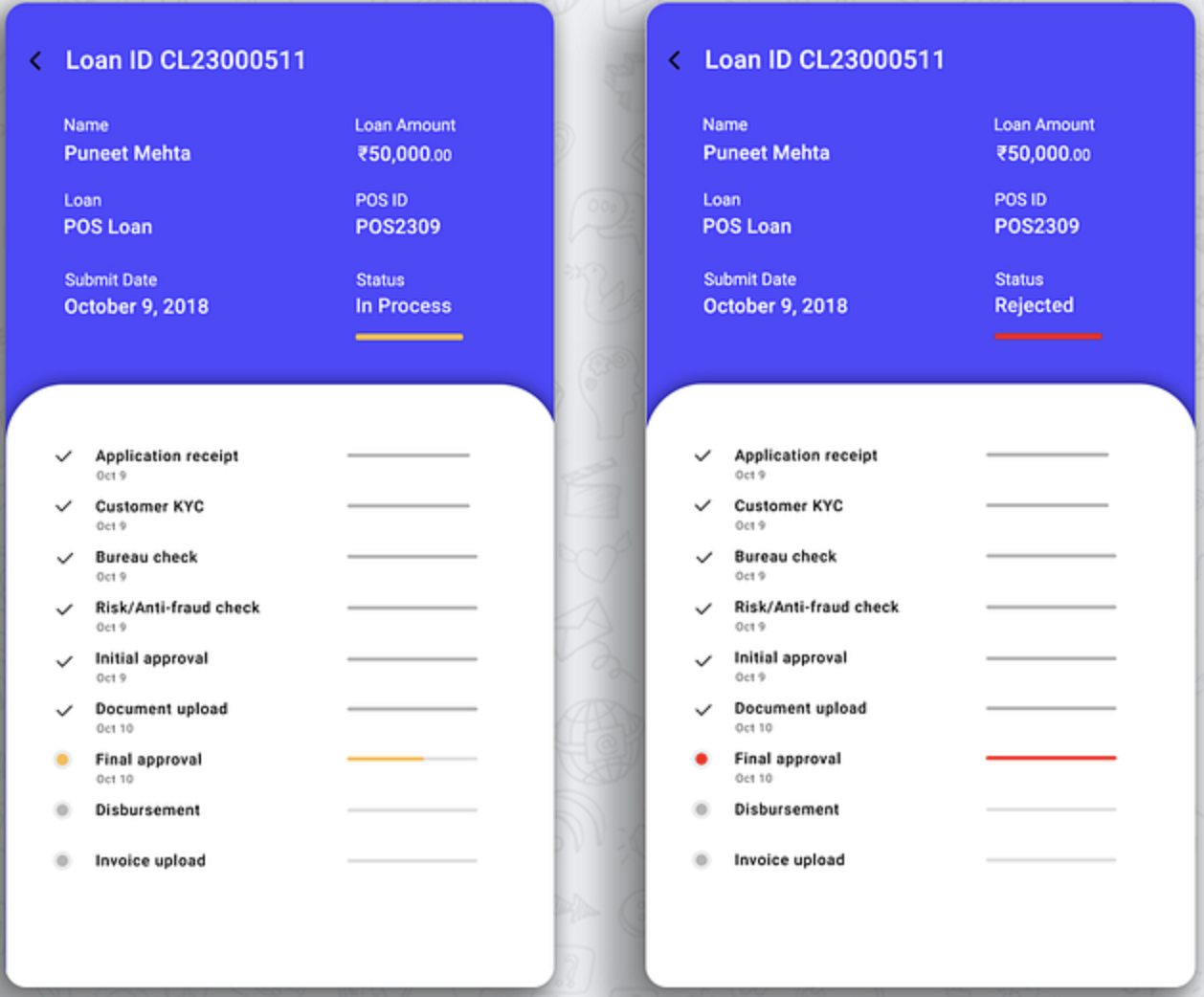

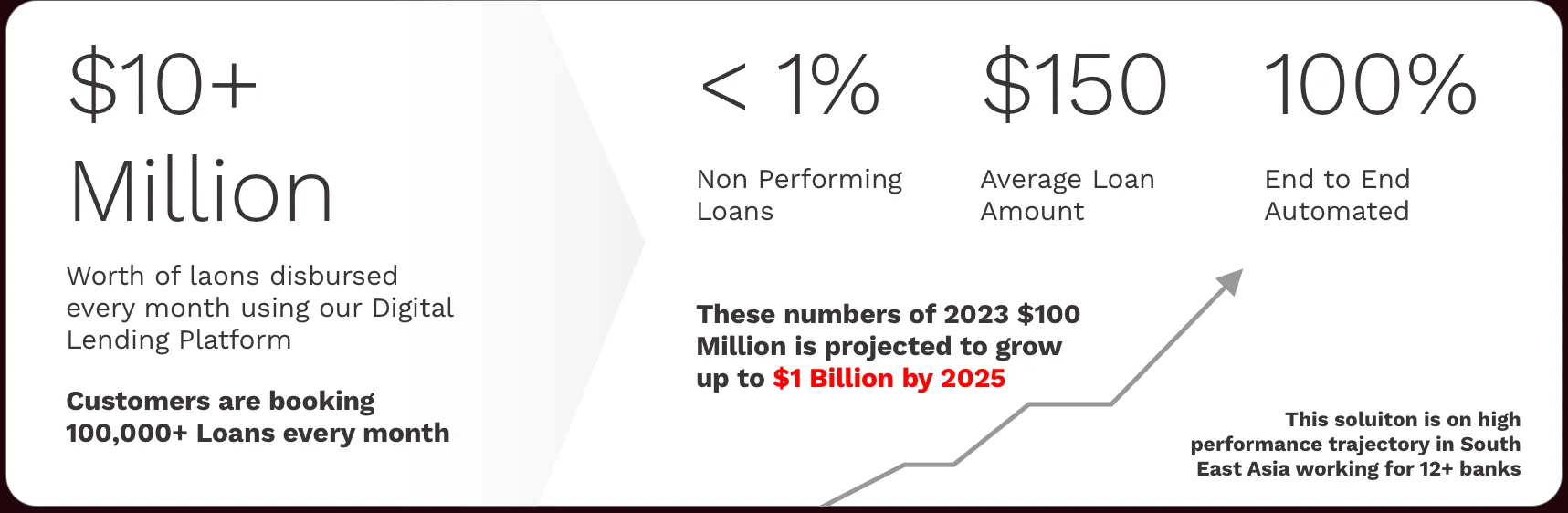

Meteoric revenue growth

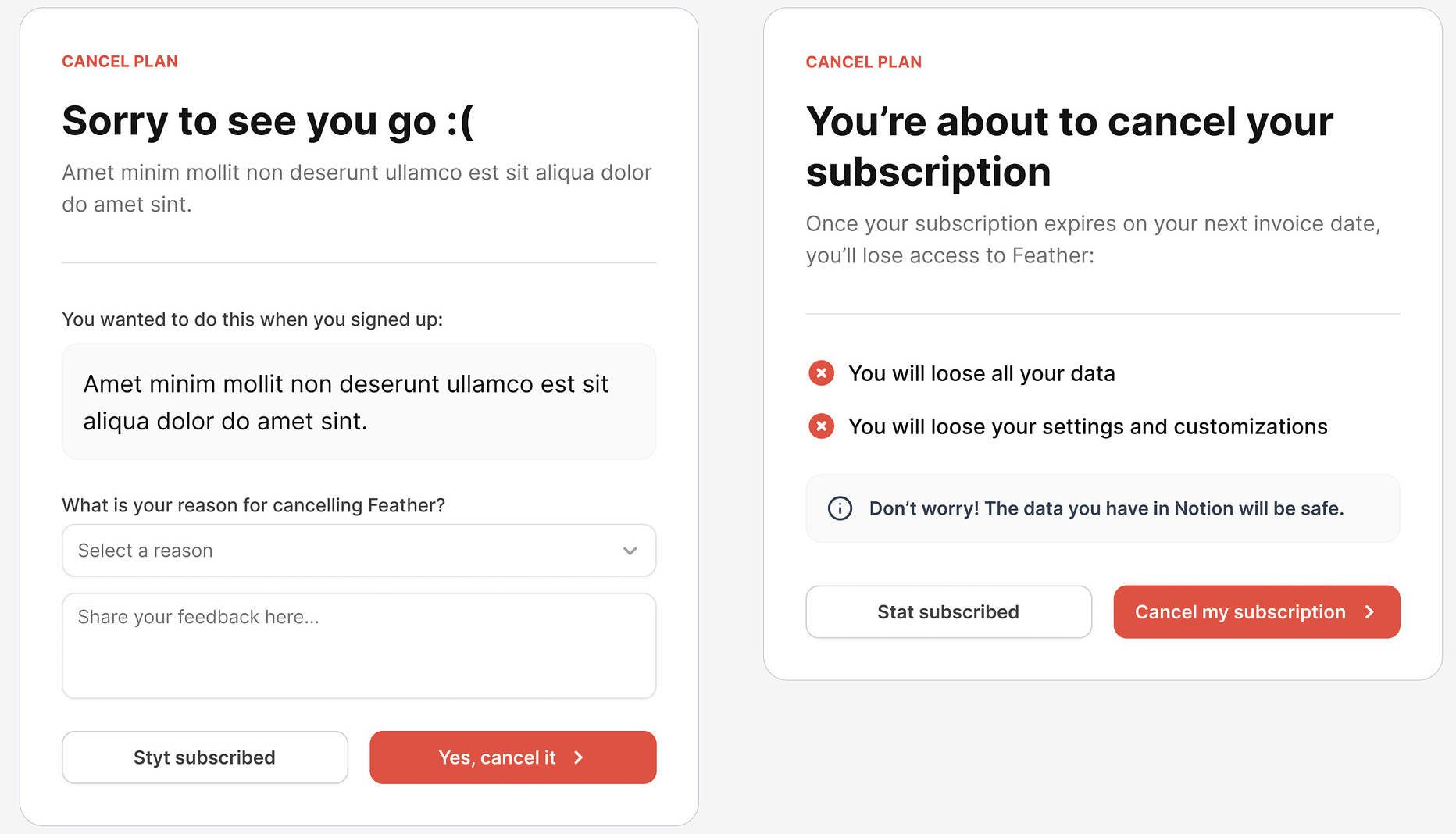

Near zero operational costs

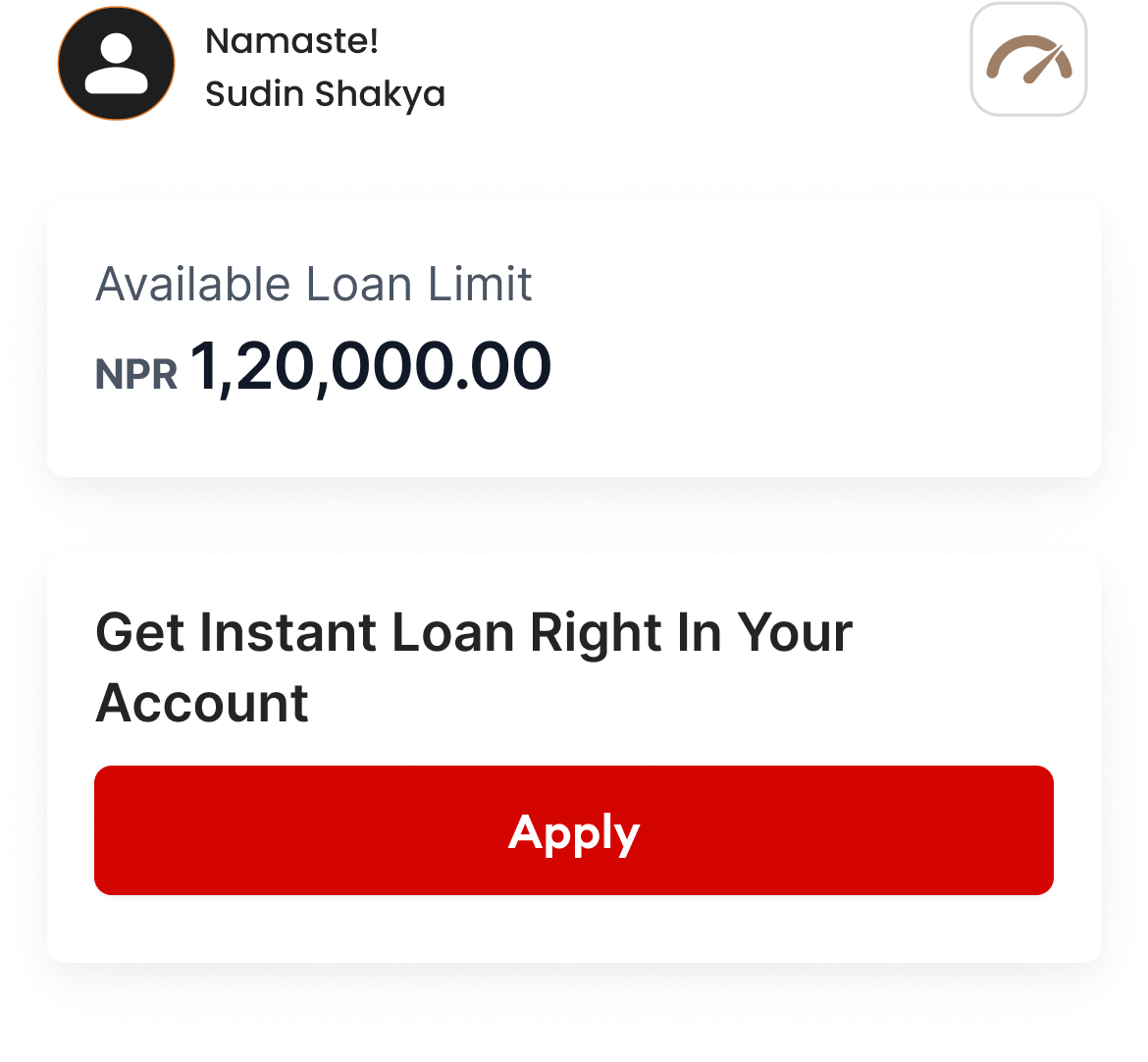

Innovative customer-centric AI scoring

Worth of loans disbursed every month using our Digital Lending Platform

Customers are booking 100,000+ Loans every month