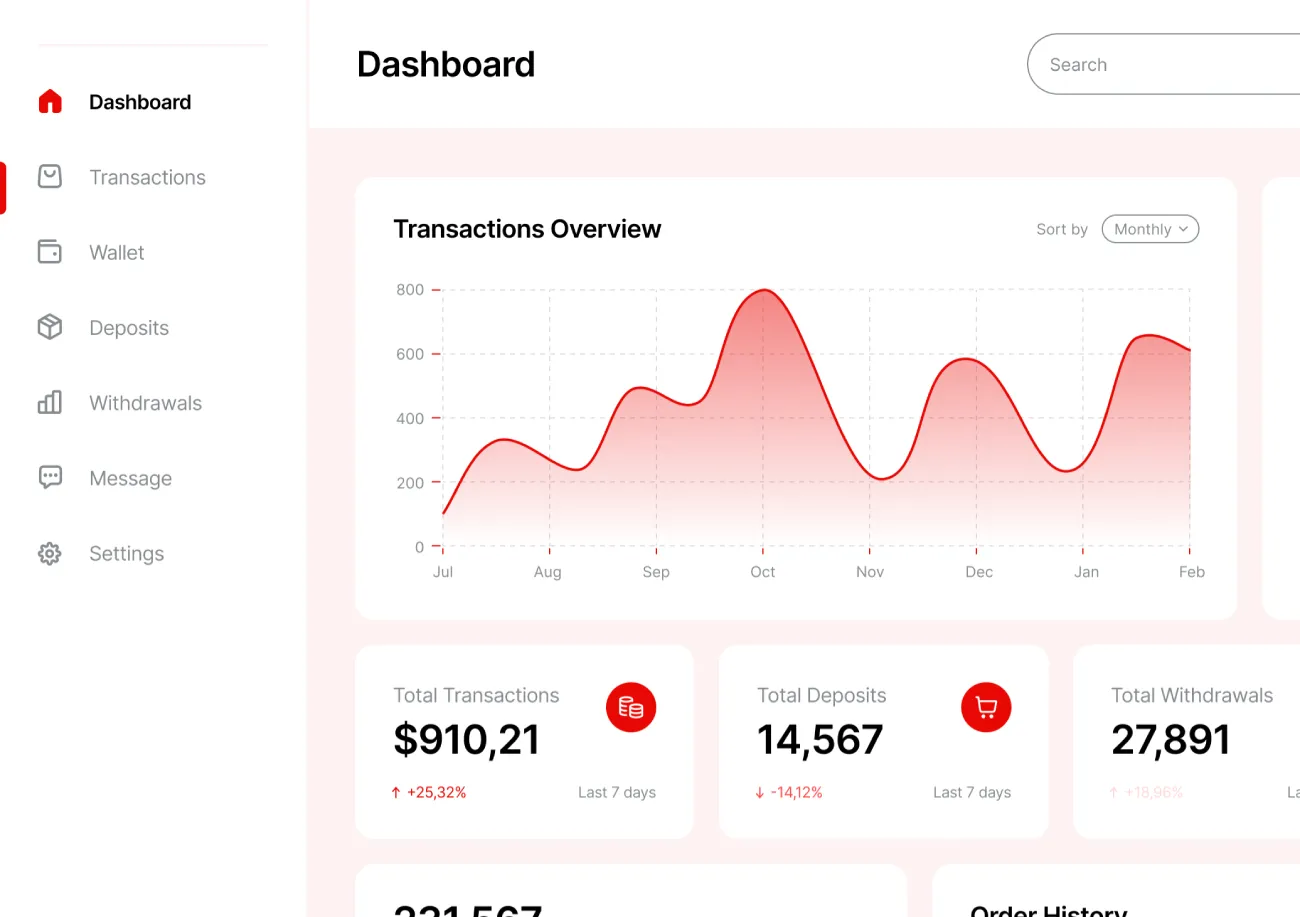

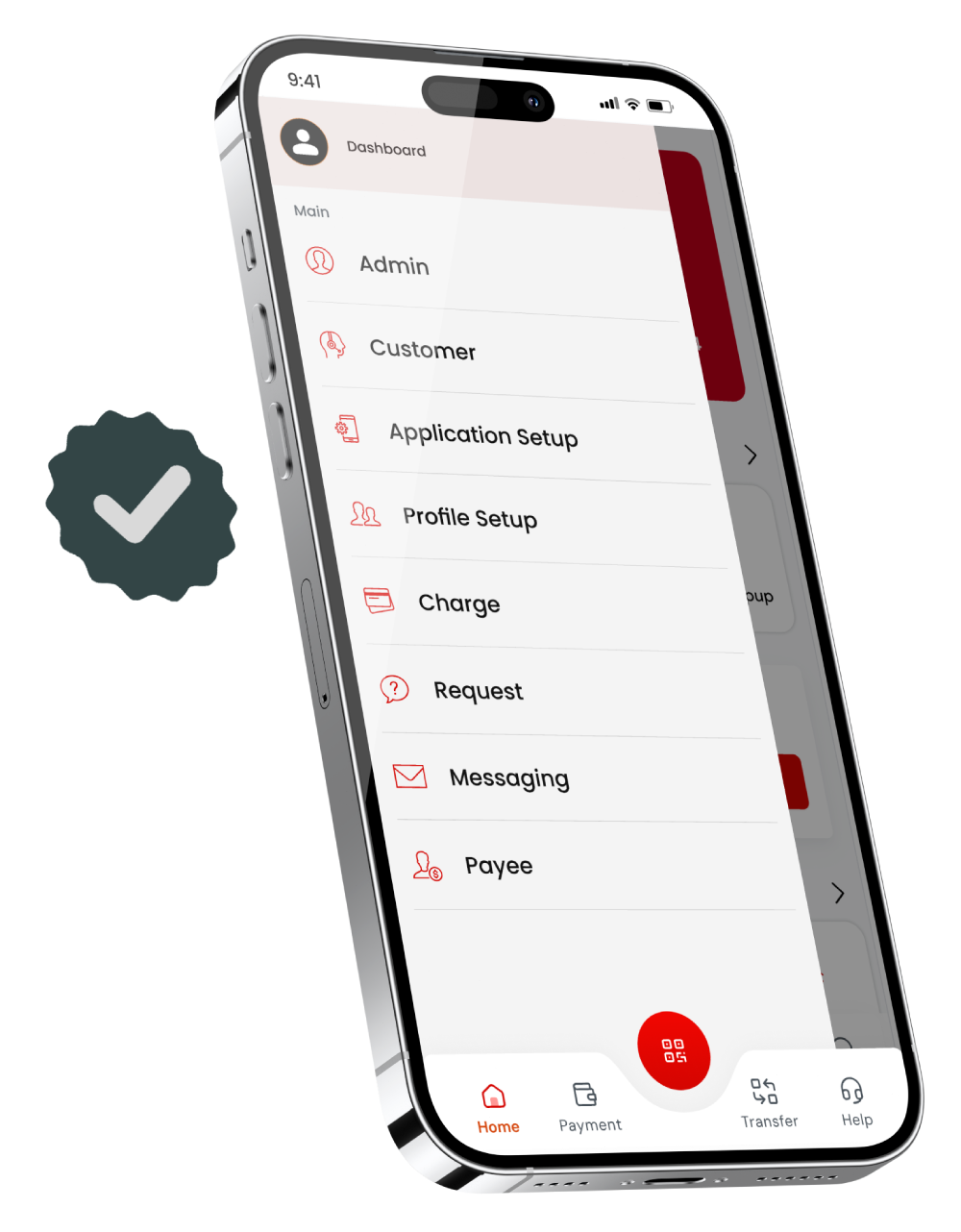

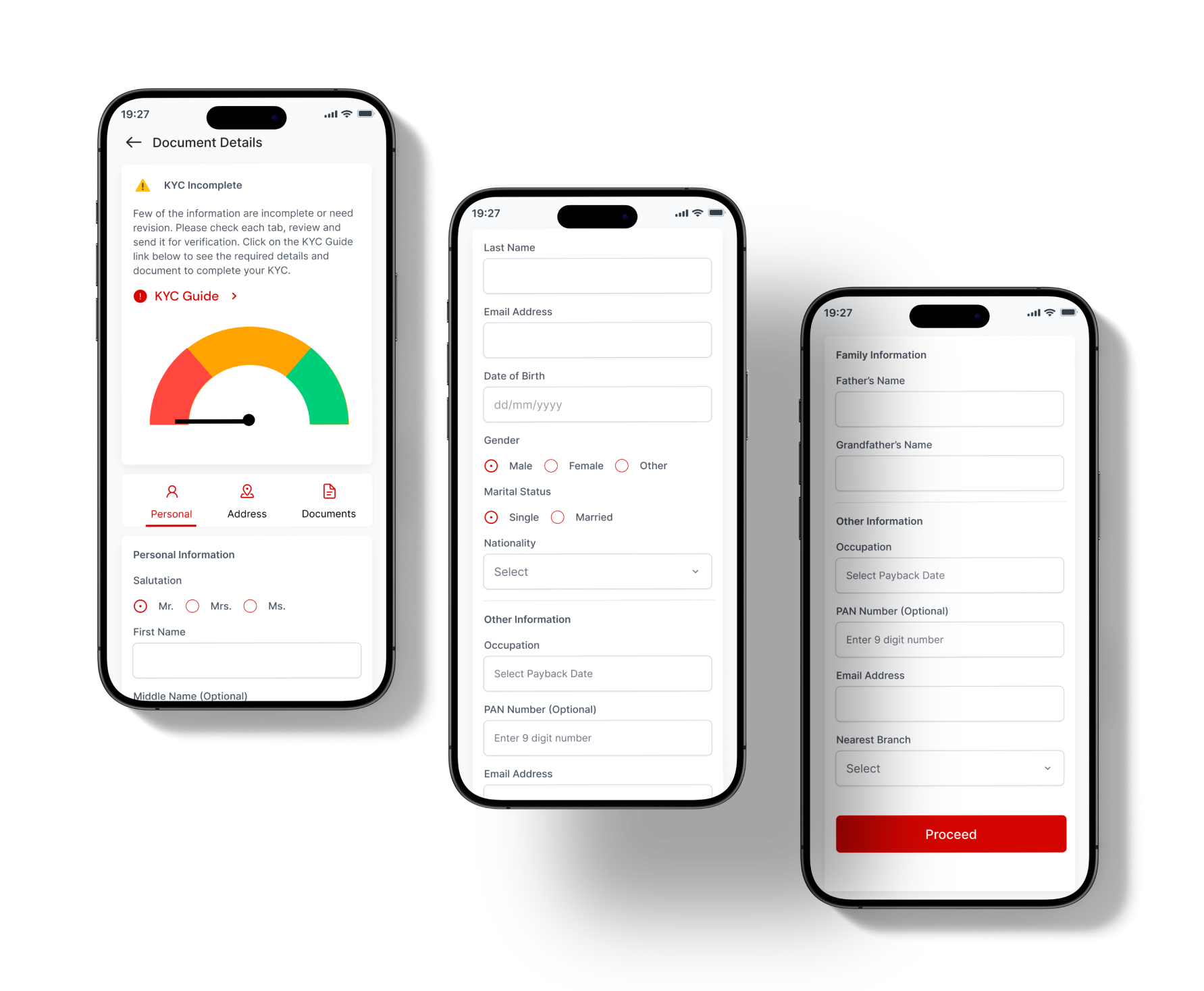

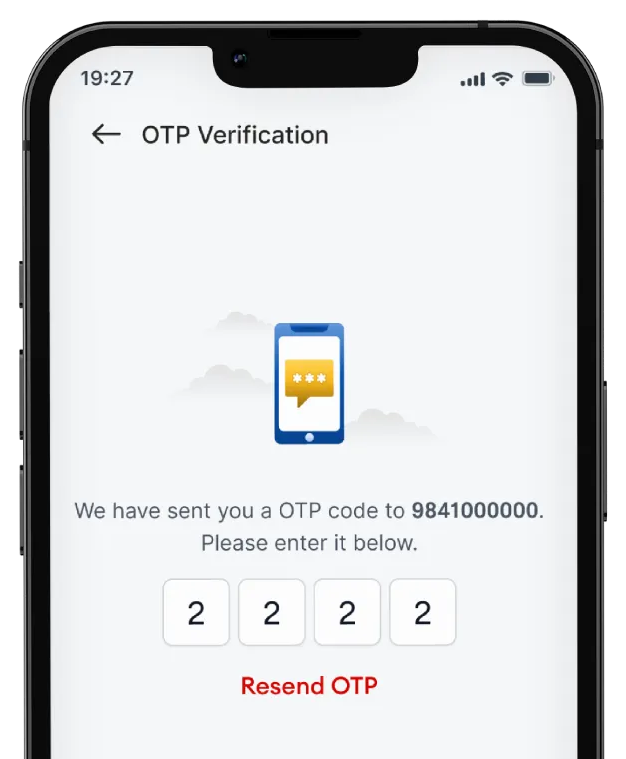

A one-window solution that allows customers to bank from single seamless interface anywhere and anytime. Have an all-in-one digital suite at your command that acts as a unified system, connecting all banking and third-party services across platforms.