Lending Has Left the Branch

A loan used to start with a paper form under fluorescent lights. Today, it can be as simple as a tap within a ride-hailing app, a QR code at a farmers market, or a “Buy now, pay later” button at checkout. These micro-moments are now credit origination points. Customers don’t apply for loans, they expect liquidity to surface instantly inside the commercial journeys they already live in.

The Rise of New Lending Touchpoints

Each digital commercial interaction now has the potential to become a moment for banks to deliver value. The difference lies in how banks choose to enable them.

Financing at checkout (BNPL)

A customer chooses “pay later” inside the shopping or bank app, extending consumer credit at the exact point of sale, deepening merchant partnerships, and creating a recurring, low-friction revenue stream.

Advances - even for freelancers

An automated system determines eligibility for a ride sharing driver or freelancer, bridging income gaps, expanding reach into underserved segments while lowering acquisition cost and driving engagement.

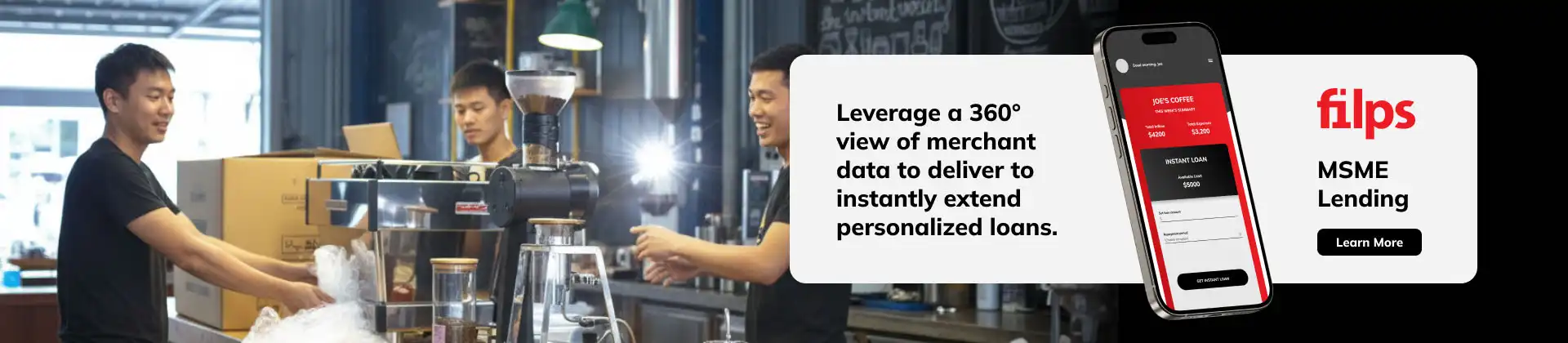

Digital lending for businesses

A local coffee shop gets working capital as needed, without extensive paperwork, funding inventory and keeping doors open through a system that leverages real-time business finance data instead of manually audited statements.

Ecosystem embedded credit

A customer transacting inside a ride-hailing, telco, or marketplace app has an option to choose a contextual loan offer, opening new distribution channels even as the bank that’s making it happen never has its app opened.

These list of examples is not exhaustive, but just a few high value use cases that Digital Lending can enable. They are distributed lending moments stitched together by digital infrastructure.

What Enables These Touchpoints

Digital Origination & Data Fabric

Seamless credit products start when data arrives, not when a form is signed. Data including incoming and outbound transactions, QR/POS feeds, and behavioal signals can be boiled down into one real-time profile. The same fabric forms the basis for credit-related decision making, so pre-qualification, lending terms, and offer logic are always consistent, and always current.

Smart Credit Decisioning & Risk Models

Manual evaluations evolve into hybrid decisioning frameworks, combining global and segment-specific parameters that account for a broad range of data. These systems allow loan parameters to continually refine themselves as data flows in, helping banks balance approval speed with risk control.

Configurable Loan Lifecycle

Disbursement, repayment, restructuring, and collections are configurable to needs and preferences of the lender. Customers stay inside the app they started in, and operations teams get a dedicated dashboard instead of spreadsheets.

API & Embedded-Lending Framework

Digital lending can work like an infrastructure that organizations can plug into, rather than a one-off custom developed solution. This “federated” architecture allows customization while allowing multiple partner integrations.

Continuous Intelligence + Human Oversight

Even with AI-driven systems, human judgment remains central to responsible lending.

Review and validation layers can be embedded across the workflow — from document verification to credit approval — ensuring that exceptions, policy checks, and compliance reviews are handled with context and control. This balance of automation and oversight helps banks maintain trust, transparency, and regulatory alignment across digital lending operations.

In short, lending becomes a set of digital experiences underpinned by a single, adaptable engine. Banks that own this architecture can place credit inside any journey without re-platforming each time the means of delivery of credit changes.

The Future: Every Digital Moment Is a Lending Moment

The future of credit is not defined by loan categories, but by interaction surfaces. Banks meeting customers at the point of need rather than customers seeking credit through lengthy workflows.

Every transaction, from a mobile purchase to a service subscription, can become a potential credit insight if a bank’s systems are ready to power it. Banks that embrace this model will stop thinking of lending as a product line and start thinking of it as an embedded service layer, intelligent, contextual, and constantly active. That is the mindset will shape the next decade of digital finance.