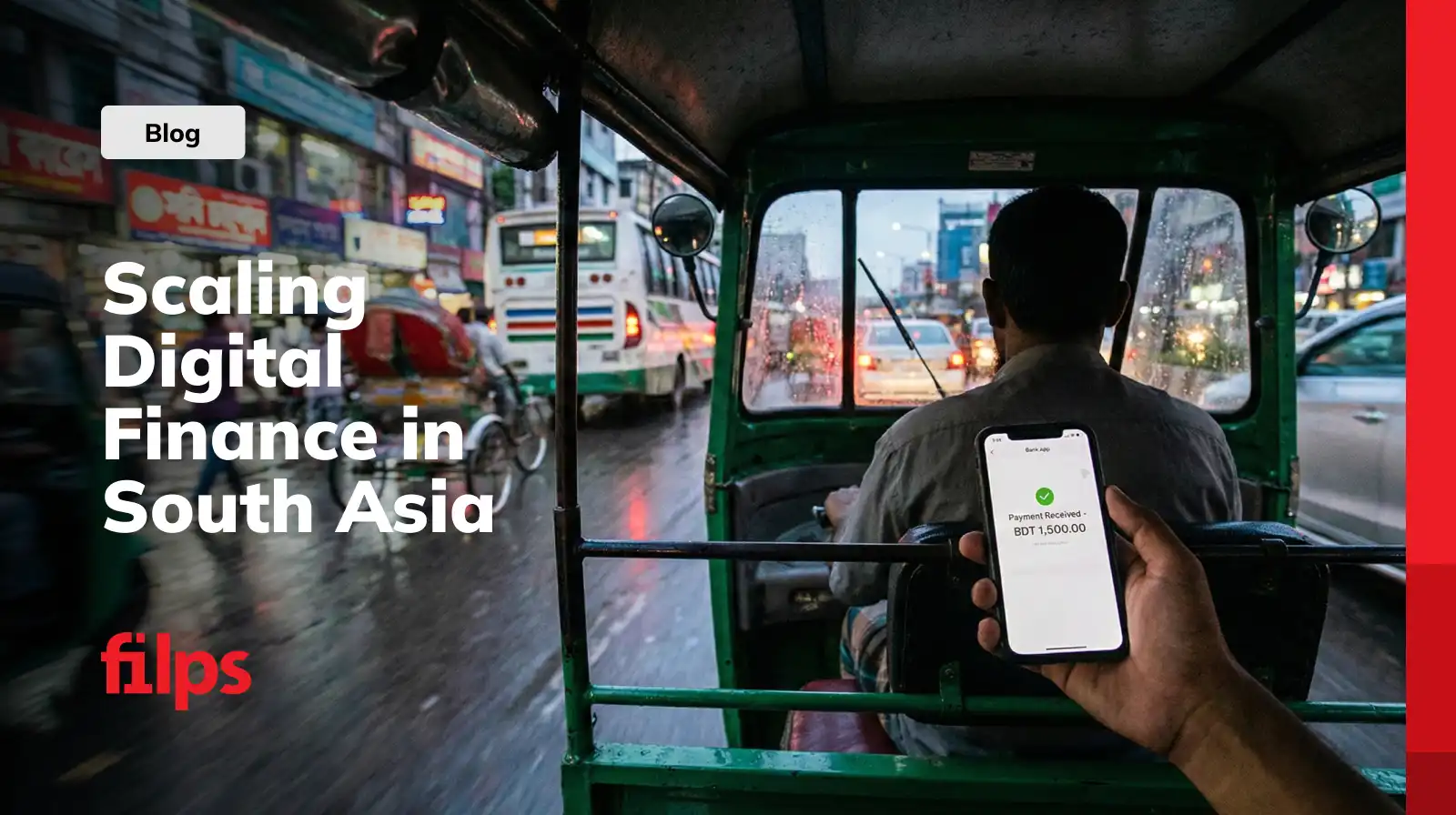

South Asia’s first wave of digital transformation in banking was about distribution. The numbers are staggering. In Pakistan, JazzCash alone processed over PKR 15 trillion in 2025, anchoring a massive ecosystem of 57 million+ customers. In Bangladesh, the MFS sector now commands over 239 million registered accounts.

Distribution is as good as solved. The paths to get access to the masses are built.

But for established Banks, NBFIs, and Telcos, a quieter second wave has arrived. The challenge is no longer about acquiring users, it’s about serving them profitably in a market that could break legacy infrastructure.

The New Reality

When you try to scale a digital finance or banking product in 2026, it is not just about mobile banking app development. You are walking into a regulatory and technical minefield.

Fragmented Rails

In Pakistan, you can't just launch a wallet. You must orchestrate RTP payments / Raast Person-to-Merchant payments across 40+ banks while navigating the SBP’s new PKR 3.5 billion subsidy model for merchant onboarding.

Meanwhile, in Bangladesh, it’s not just about your core banking system anymore. You have to handle Binimoy (IDTP) interoperability while preparing to compete with the 12 agile digital bank contenders (including giants like bKash Digital and Nova) currently vying for licenses under the central bank's strict new capital rules.

Regulatory Velocity

Compliance used to be a quarterly checklist. Now, it’s a live operational hurdle.

Pakistan: The SBP is piloting its Central Bank Digital Currency (CBDC) for FY25-26. Is your ledger ready for a tokenized rupee?

Bangladesh: The BFIU has tightened AML/CFT oversight, meaning your "fit-and-proper" checks and KYC flows need to be dynamic, not static.

The Coordination Tax

Launching a simple Buy Now, Pay Later (BNPL) product today requires buy-in from three different worlds: Telcos (for data), Banks (for settlement), and Regulators (for permission).

The Result: Your top engineering talent spends their time debugging settlement errors between legacy cores and new payment rails, leaving only little time for actual innovation.

The Strategic Shift: Innovation Without Renovation

One of the biggest challenges in South Asian finance is a mismatch between market expectations and how fast innovation can be delivered. The market demands new features every week, but established infrastructure operates on a cycle of years.

Trying to force high-frequency digital innovation directly into rigid backend systems is a strategic error. It creates a bottleneck where every minor product launch triggers a major engineering project.

The Solution? A "Digital Orchestration Layer."

This is where Filps Smart Middleware steps in. It acts as the connective tissue between your established foundations and the chaotic demands of modern channels.

We bridge the gap, allowing you to run modern, agile services without ground-up reinvention of your infrastructure, ensuring stability without sacrificing speed.

How Filps Accelerates Your Roadmap

Filps acts as an intelligent buffer, handling the complexity of the ecosystem so your systems of record can focus on what they do best.

The "Connective Tissue" (Federated Middleware)

Modern payment rails like Raast and Binimoy generate massive transaction volumes and require complex, standardized APIs that traditional systems often struggle to support natively. The Smart Middleware orchestrates these interactions. We standardize the chaos of fragmented payment rails and partner ecosystems into a unified service layer. We handle the heavy lifting of message processing and translation, so your main systems receive only clean, standardized instructions, protecting them from the high-velocity "noise".

Decoupled Business Logic

Traditionally, launching a "BNPL" or "Loyalty" feature meant waiting months for deep backend changes. We allow you to run business logic independently. You get the ability to track complex data like reward points, fee splits, or merchant commissions in a specialized agile layer (through a middleware integration). What you get is significantly reduced depth of changes needed in your primary systems.

Automated Workflow Orchestration Regulatory updates from the SBP or Bangladesh Bank often break hard-coded processes. We abstract workflows (like KYC steps or transaction limits) into a configurable layer. This means you can often adapt to new rules or modify user journeys at the middleware level, minimizing the need to constantly patch your underlying infrastructure for every market shift.

Scale Responsibly

The question for 2026 and beyond isn't "Do we need new technology?" The question is: "How can we modernize our capabilities without getting bogged down in endless infrastructure projects?"

The next chapter of South Asian finance belongs to the Orchestrators.